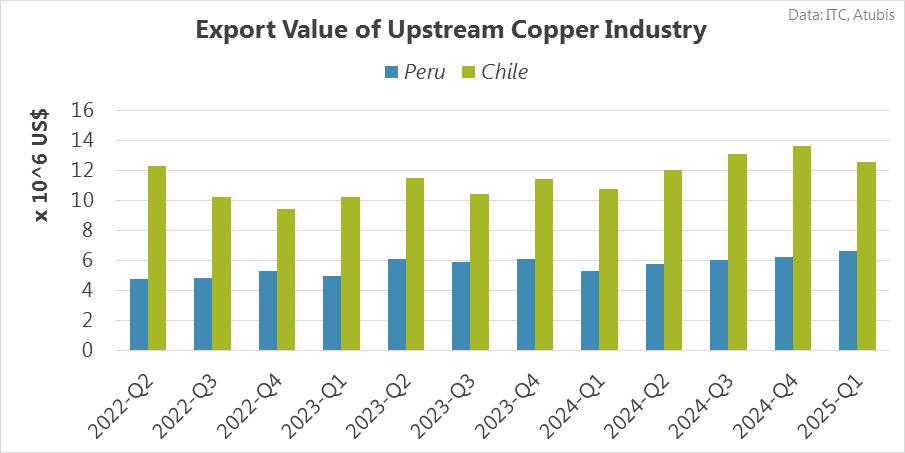

Between 2022-Q2 and 2025-Q1, the export values of the Upstream Copper Industry in Peru and Chile showed a moderate and positive correlation, meaning they generally moved in the same direction. Volatility for both countries remained limited, indicating relatively stable export performance. Peru’s exports followed mostly slight upward trends with low volatility, except for a brief slight decline in the late middle period, before rising again toward the end. Chile started with a slight downward trend, but then maintained slight upward trends with low volatility through most of the period. By 2025-Q1, Peru’s export value reached about USD 6.61 million, growing 23.9% year-on-year, while Chile’s exports rose to around USD 12.6 million, up 16.8% year-on-year. Over the whole period, Peru recorded a higher compound growth rate (3.0%) than Chile (0.2%), despite Chile’s consistently larger export value.

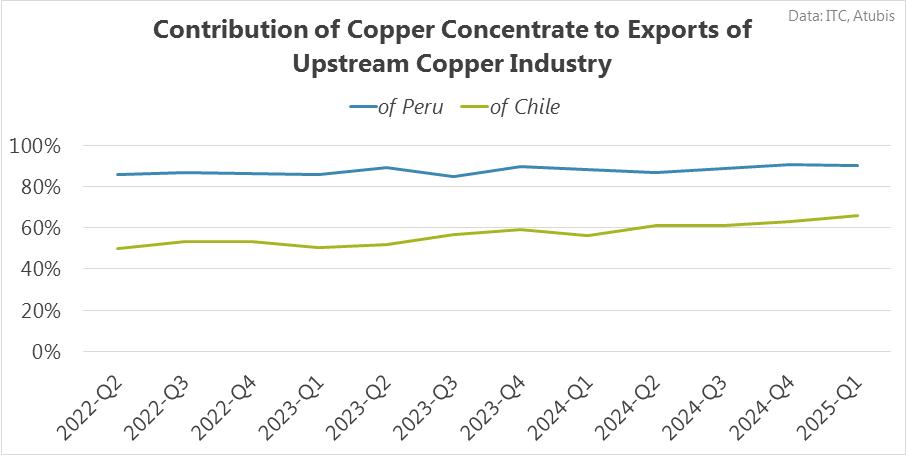

From 2022-Q2 to 2025-Q1, the ratio of Copper Concentrate to exports in the Upstream Copper Industry showed limited volatility in both Peru and Chile, indicating stable trends throughout the period. Peru’s ratio reached a low of 84.8% and a high of 90.4% in 2024-Q4, while Chile’s ratio ranged from 49.8% to 65.7%, both extremes occurring in 2025-Q1. Overall, Peru’s ratio grew by 4.1 percentage points, from 85.8% to 90.0%, while Chile’s ratio increased by 15.8 percentage points, from 49.8% to 65.7%. This shows that although Chile experienced stronger relative growth, Peru maintained a consistently higher ratio.

The correlation between the two countries’ ratios is good, meaning they generally moved in the same direction. Both Peru and Chile displayed a slight upward trend with low volatility across the initial, early middle, late middle, and closing periods. By 2025-Q1, Peru’s ratio rose by 1.6 percentage points year-on-year to 90.0%, whereas Chile’s increased by 9.5 percentage points to 65.7%. These results confirm that Copper Concentrate held a more prominent and stable position in Peru’s upstream copper exports, consistently outperforming Chile over the full assessment period.

Between 2022-Q2 and 2025-Q1, Copper Concentrate played a more prominent role in Peru’s Upstream Copper Industry exports than in Chile, accounting for about 87.6% in Peru versus 56.4% in Chile. Throughout this period, its position in Peru remained consistently higher, with Peru holding the top spot in more quarters than Chile. Over the past 12 quarters, Copper Concentrate clearly maintained its important and leading role in Peru’s upstream copper exports, consistently outperforming Chile. Overall, these observations highlight the stronger and more influential presence of Copper Concentrate in Peru’s upstream copper sector compared to Chile.