China is the largest world’s steel producer and only in 2022, it produced over 1bt steel. Despite the fact that the country is one of the biggest iron ore producers, it’s also accounted as the largest iron ore importer in the world due to its high iron ore required to produce steel.

Australia and Brazil are the largest producers and exporters of iron ore in the world which a huge part of their production is being bought by China. The iron ore production volume of Australia was 932mt in 2022 and this volume for Brazil was about 430mt.

Iron ore is the main raw material for steel production and 98% of this ore is used in the steel industry. As it’s said earlier the largest producers and exporters of this material are Australia and Brazil. China as the world’s biggest steel producer has a high dependence on this mining material. So, in order to provide its requirement in the steel industry, in addition to the iron ore production, this country imports a huge volume of this ore from variety countries all over the world in different types like run of mine (ROM), iron ore fine, concentrate or even pallet.

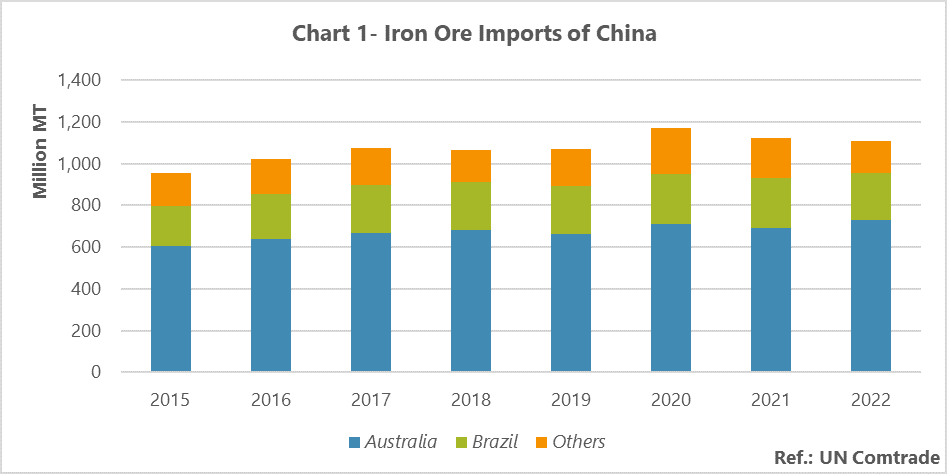

China is known as the largest iron ore importer in the world; in 2022, its total import of iron ore and all mining products was 1.1bt which 730mt of this volume imported from Australia and 226mt was from Brazil. The below figure shows China’s iron ore import in 2015-2022.

China’s iron ore import had an upward trend until 2020 and then it decreased owing to the drop in steel production in 2021 and 2022. Bloomberg reported that China’s government has made a decision about controlling steel production over the coming years and keeping its volume lower than the volume in 2020.

Australia, major iron ore supplier for China

In view of the close distances between Australia and China, this country’s share in China’s iron ore import market has been always more than Brazil’s share. Considering the grade of Australia’s iron ore is lower than that of Brazil, the export of Australian iron ore to China is more in the type of concentrate, while, Brazil iron ore often is exported in the type of crude iron ore to China.

For instance, Australian iron ore FOB in the fourth quarter 2022 was $98.1 and FOB for each tonne of Brazil’s iron ore in the same time was $61. In addition to the close distance between Australia and China, more production is the other reason for the fact of Australia is China’s largest iron ore supplier.

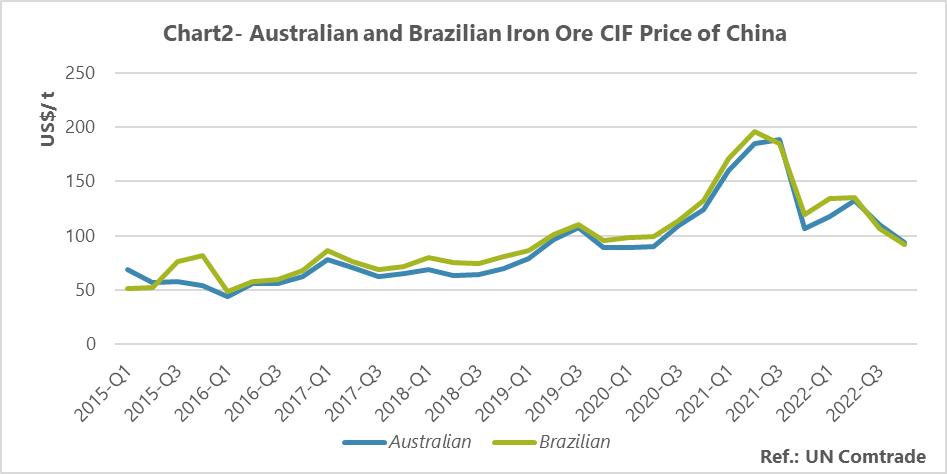

It’s likely that the price has been effective in China’s decision to increase or decrease the share of these two countries. For example, in the second quarter of 2018, in China’s import market, CIF for each tonne of Australian iron ore decreased by $5.4 compared to the first quarter of the year and CIF for Brazilian increased by $8.6 and this matter gave a rise that Australia’s share from 63.9% in the first quarter of 2018 reached 65.4% in the second quarter of 2018 and in contrast, Brazil’s share from 22.6% in the first quarter of 2018 reached 20.4% in the second quarter in 2018.

It should be mentioned that due to more distance between Brazil and China compared to Australia and China, cargoes exported at the same time, would not arrive at the same time to China and usually Brazilian cargoes are delivered some months later after Australia’s cargoes. Correlation of Australia and Brazil to China is investigated with different delay and shows that correlation will have the highest amount if correlation coefficient is calculated in a case that Brazilian data is examined with a lag period compared to Australia. Therefore, in the investigations carried out in this report, a three-month gap period has been considered for Brazil. In other words, the data of Australia have been compared and analyzed with the data of an earlier period in Brazil.

After 2018, the price as a parameter did not have much effect on the shares change of these two countries. This may be due to the environmental restrictions that have been put in China to reduce carbon emissions. The Chinese government considered winter restrictions in order to reduce the emissions caused by steel production, in such a way that steel producers are obliged to reduce their production in the winter season to a certain percentage. In addition to reducing production, one of the ways to reduce pollution in the steel industry is to use high-quality iron ore. One of the harmful impurities in iron ore is alumina. In addition to causing problems in the iron production process in blast furnaces, this substance also increases the amount of energy consumed. Therefore, as the amount of alumina in iron ore increases, the quality of iron ore decreases and its pollution increases.

Because Brazilian iron ore contains less alumina than Australian iron ore, it has a higher quality and price. Therefore, iron and steel producing companies in China may prefer higher priced iron ore for environmental reasons. For example, in the fourth quarter of 2019, in the Chinese import market, the CIF per tonne of Australian iron ore decreased by $18.3 and the CIF per ton of Brazilian iron ore increased by $9.4. However, Australia’s share in China’s iron ore imports fell from 62.3% to 58.5%, while Brazil’s share went from 15.8% to 21.3%.

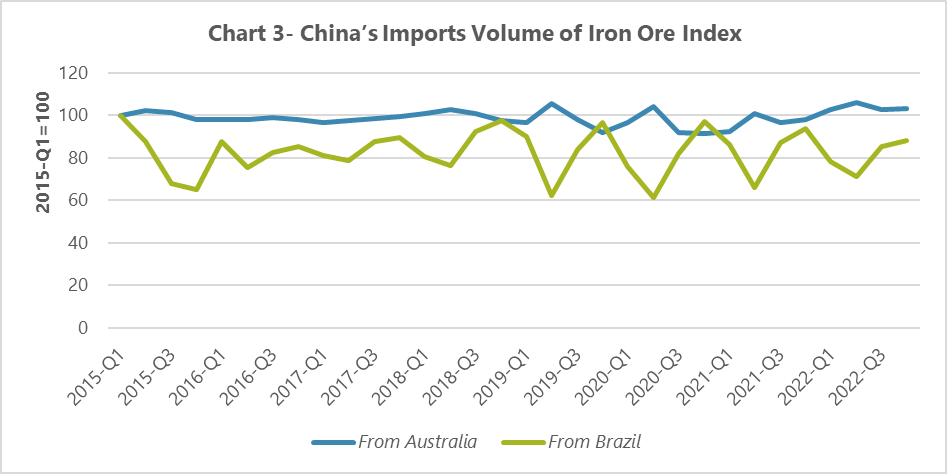

Growth of imports index from Brazil in each year’s fourth quarter

In the figure below, the import index from Brazil and Australia has been indicated based on the first quarter of 2015. As it can be seen in this figure, it seems that the import index from Brazil had an increasing trend in the fourth quarter compared to other quarters in most years. The reason of this matter can be the environmental restrictions in the winter. In other words, it is necessary to reduce the emissions of steel producers in the first quarter of every year. Therefore, the import of iron ore from Brazil, which has less pollution, has increased in the fourth quarter of every year.