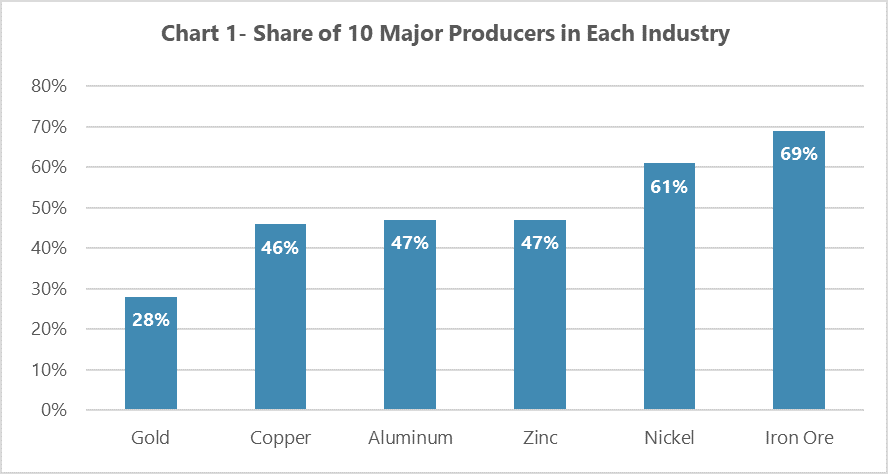

It seems that it has been started a new generation of mergers and acquisitions activities in the gold industry as the result of the merging of two mining companies, Barrick Gold and Randgold in March 2019. This industry is highly fragmented; in a way that the 10 largest producers’ production shares of the global gold supply is less than 30%.

In other words, the need to maintain production stability has caused integration (merger and acquisition activities) to be a medium-term driver of the gold chain mining sector. Creating one of the largest gold production companies in the world and the construction of the largest gold production mining complex in Africa are the probabilities in this new trend.

The gold industry is the most fragmented industry among all existence industries; many companies have been entered to this industry easily by the help of some of the most important factors such as limited barriers to enter the industry, technological innovations to process hard stones at a reasonable cost and the ability to maintain profitability in small capacities. In many of the mining and metal industries, around 10 largest producer companies constitute 50% of the global production, but this number is less than 30% for gold industry.

Large gold producers are seeking their own growth and development in different ways. Some companies prefer natural growth by financing exploratory processes and using the funds they get to explore new resources, they are looking to develop their next big project. It has to be said that this method is such a risky and costly way in a fluctuating market and considering the uncertainty in geopolitics and strengthening the nationalism of resources.

Therefore, many of the gold producers have chosen the merge and acquisitions to develop. Increase in share of production, the challenge elimination of lowering the gold carat reserves, and increasing cooperation between production complexes with the aim of reducing operating costs are some distinguished factors for producers of this industry. In addition, there are some other factors in the merger and acquisition which lead to the variety of the available products due to the having by- products of merged or acquired mines. Eventually, the final goal of the merger and acquisition activities is the creation of value added by increasing income, especially during high price levels, and increasing the lifetime of operating mines.

Gold industry has been encountered big trades to integrate the industry over the course of the last 5 years. 2 of the recorded trades in 2019 are related to world’s 2 large gold producers; the first is the merge of Barrick and Randgold companies and the second one is the purchase of Goldcorp Company by the Newmont. In the same year, Newcrest Company entered into a joint investment with Imperial Metals which owned 70% of Red Chris’ copper- gold mine in British Columbia, Canada. Furthermore, the merge process of Agnico Eagle and Kirkland was completed to the value of $10,6bn in 2022. Thanks to this merger, the world’s third gold producer has been created. In early 2023, Pan Americans Silver confirmed the purchase of Yamana Gold which means that Yamana’s all metal assets has been assumed by Pan American Silver; also, Agnico Eagle made a purchase of 50% of Canadian Malartic gold mine which was not its owner. Maybe the largest trade among the large producer companies since 2019 which heard was the probability of the Newcrest purchase by Newmont.

Newcrest Purchase; Secure Investment with Low Cost

The probable of Newcrest purchase by Newmont leads to the creation of a gold mining company with 23 mines in 10 countries. If this purchase happens, the total production of Newmont with 9m oz (255t) annual volume will increase by 48%. This elevate will be from Cadia Valley, Telfer, and Red Chris mines which will provide the access to cooper for this company as well.

Enthusiasm of Newmont for Newcrest purchase is predominantly because of this company’s mines location and their reserves. 4 active mines of Newcrest’s 5 active mines are located in Australia and Canada that they’re in the first rank in the mines’ category; this rank belongs to mines which are in safe mining areas. In recent years, geopolitical tensions, nationalism of resources and the challenges of providing social permits have intensified which has challenged the production activity of international mining companies. Purchasing of companies and mines located in safe mining areas provides a platform for large companies to be able to cooperate with relatively higher costs.

Besides, based on the sources and reserves evaluations in 2022, adding Newcrest’s assets and gold reserves to Newmont’s proven and probable gold reserves will make a 50% increase and it will reach 144m oz (085,4t) while this company’s amount of measured and inferred resources will be doubled and will reach 213m oz (038,6t) from 113m oz. The other charm of Newcrest purchase is its copper resources which increased from 19mt at the end of 2021 to about 25mt in August 2022.

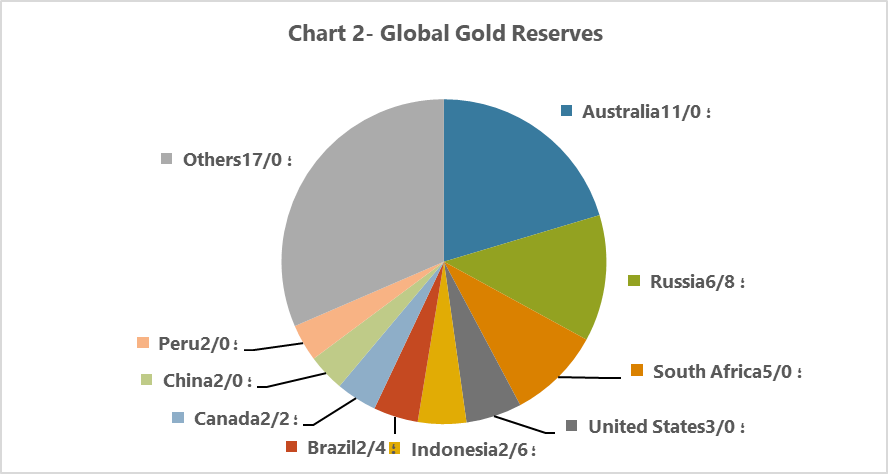

The world’s gold resources and reserves have concentrated in Australia, Russia, South Africa, and the USA. On the one hand, geopolitical tensions are a factor that complicates or hinders investment in Russian gold production; On the other hand, the existence of electricity access challenges and political problems are act as an obstacle for development of gold resources in South Africa. So, the huge gold reserves in Australia is accounted as the only chance to a relatively secure investment for mining companies which are eager to diversify their portfolio and guarantee the future gold production.

Restricted Growth of Gold Production since the Century Beginning

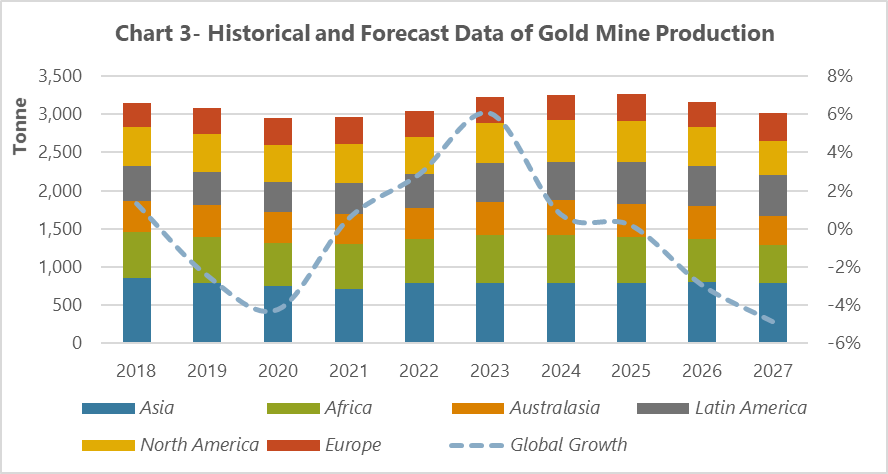

According to Cru Research Institute, the total detectable production of mining gold (mining gold production excluding manual, illegal and clandestine state mining) has increased from 547,2t in 2001 to 045,3t in 2022 which it is equivalent to an average annual growth of 0.9%. The important is that this growth has been affected by the increase in production of China, Russia, and Kazakhstan, while the production of the large producer countries, South Africa and the USA, has been decreased.

At the beginning of the century, the total gold production of China, Russia, and Kazakhstan constituted 14% share of the global gold production which reached 24% in 2022; in contrary, the production share of the USA, Australia and South Africa from the world production which was about 46%, dropped to almost 26%. The access to China and Russia’s gold mine for investing is a hard work; therefore, the active mining companies in the other countries are turned to the great actors but in a tiny part of the industry. This challenge has intensified with the war of Russia and Ukraine.

Continuation the Mergers and Acquisitions Process in the Gold Industry

The mining gold production is entirely fragmented geographically and owing to the fragmented gold mining all over the world, this product supply is not much exposed to regional shocks; so that, gold production and supply has more stability compared to other metals. For instance, the total production of 10 large gold producer countries in the world had a 56% share of the global production in 2020; this number is approximately small in comparison to other metals such as zinc and copper that 80% of their global production is in 10 large producer countries.

It’s predicted that the mining gold detectable production will be 230,3t in 2023 that it shows a 6,08% growth compared to 2022. This growth in production is because of the production increase in Latin America, Australia, Russia, and Africa that covers well the decrease in Asia’s production. Analysts believe that the growth of gold production continues for 3 years in a row and finally, it reaches 261,3t, its highest point, in 2025; but after that it will decline as the production growth slows down in North America, Australia, and the intensification of Africa region’s production speed.

Signals for Gold Price Growth

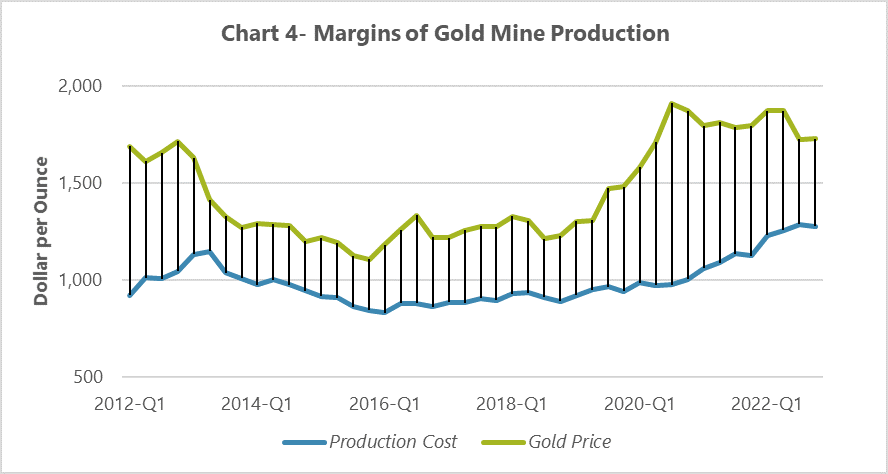

After a mutation in gold price in 2020, gold had a limited growth in 2021 and practically it was unchanged in 2021. However, the price is expected to remain increasing as positive sentiment returns to the gold market. With the help of high but not unbridled inflation, intensifying risks of economic recession and the beginning of geopolitical tensions, the year 2023 was associated with the growth of gold prices and it is expected that it will continue to grow during this year as a low-risk asset. Generally, it is forecasted that the gold price during the short and long term vision, it will continue to increase following the predictable change in the monetary approach of the Federal Reserve and the possibility of interest rate cuts from 2024.

The key driver for decision adopting related to the merger and acquisition in the mining sector is the gold price. High price levels provide a favorable support for the future buyers of the industry to strengthen their cash flow and improve their profitability under its influence; in such a situation, the financial power of these companies and naturally the desire to invest in them increases. However, the growth of gold prices in the market also increases the value of mining assets. This means increasing the enthusiasm of productive companies to ensure the sustainability of their future production and reserves growth through mergers and acquisitions processes; because the right move (decision) is to ensure the stability of production before the complete bullish market (stabilizing the upward trend in the market).

The Plan to Create the Largest Gold Mining Complex in Africa

Gold Fields and AngloGold Ashanti companies have offered the combination of their neighboring mines located near Tarkwa in the western region of Ghana. Regarding this issue that the total production of these 2 companies reaches 900,000 oz (25,5t) annually, this merger would be the reason to build the largest gold mining complex in Africa and the world.

After the Newmont propensity, the American company, to purchase Newcrest, the Australian company, this plan is another reason for the integration of the gold industry (in mining sector).

These 2 companies’ idea about merging Tarkwa and Iduapriem mines with the same mineralization and constitute an open-pit mining complex with an 18 year early lifetime. With the implementation of this plan, it’s expected that during the first 5 years of the utilization, the average of production will be 900,000 oz (25,5t) and in the rest of this period reach 600,000 oz (17t). Gold’s sustainable production cost of the new complex over the first 5 year will be less than $000,1/oz and in the rest of the utilization time will remain less than $200,1/oz.

90% share of Tarkwa is allocated to Gold Fields Company which is its owner and the remaining 10% share is for Ghana’s government. Iduapriem mine is also fully owned by AngloGold Ashanti. As a result, upon completion of the merger, without considering the government’s share, Gold Fields will own 66.7% and AngoGold Ashanti will own 33% of their joint venture.

Successful Mergers; Driving More Asset Sales and Moving towards Integration

Based on analysts’ idea, it is expected that the sale of mining assets with gold’s co-products do not continue, which is as an opportunity for mining producers except gold mining producers, till they could expand the gold’s share in their assets basket. More importantly, investors are looking for evidence that through integration, the gold industry can optimize its utilization costs, provide reliable profit margins and increase its equity. If these evidences are provided to them, the gold industry will be more integrated with the help of mergers and acquisitions.

In general, the forecast of gold price growth, the need of mining companies to develop reserves and production sustainability, and more importantly, the advantages of integration that were discussed earlier, will affect the vision of the global gold industry in the medium term future by the process of mergers and acquisitions. With the merger of two mines in Ghana, the largest gold mining complex in the world was formed in Africa, and if Newcrest is agreed to be purchased by Newmont, it will build one of the largest gold production companies with more than 23 mining assets in the world.

Due to the existence of reserves of about 740t of gold in the country and the lack of adequate utilization of the reserves compared to the global industry, it is expected that the domestic industrialists will also solve the environmental and technical challenges of production in order to develop the reserves and the sustainable growth of production with the integration caravan in the world which is considered to be a suitable method to compensate for the decrease in mining carat, increase market share, reduce production costs, increase available reserves and increase profitability.