Graphite electrode is used in two sectors of electrical consumption and metal products, including silicon metals and steel, by the electric arc furnace (EAF) method, which considering the growth of related industries, including the aviation, electronics and packaging industry, the market of graphite electrodes is expected to experience an upward trend.

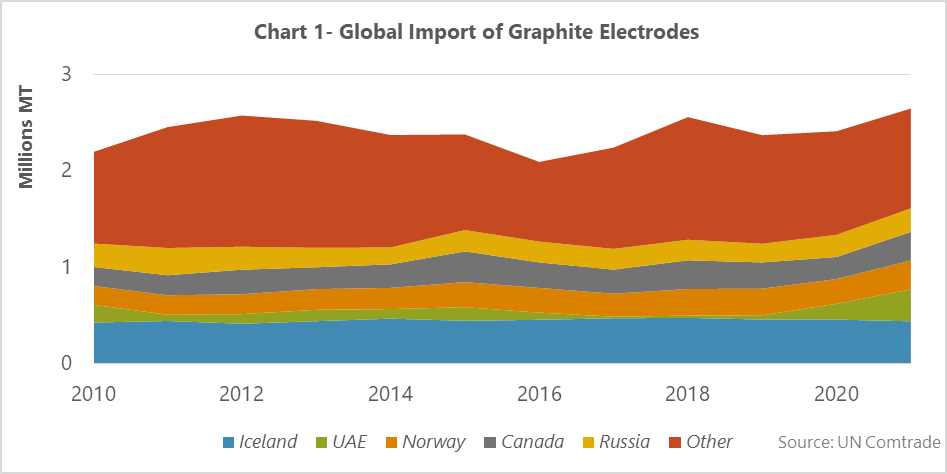

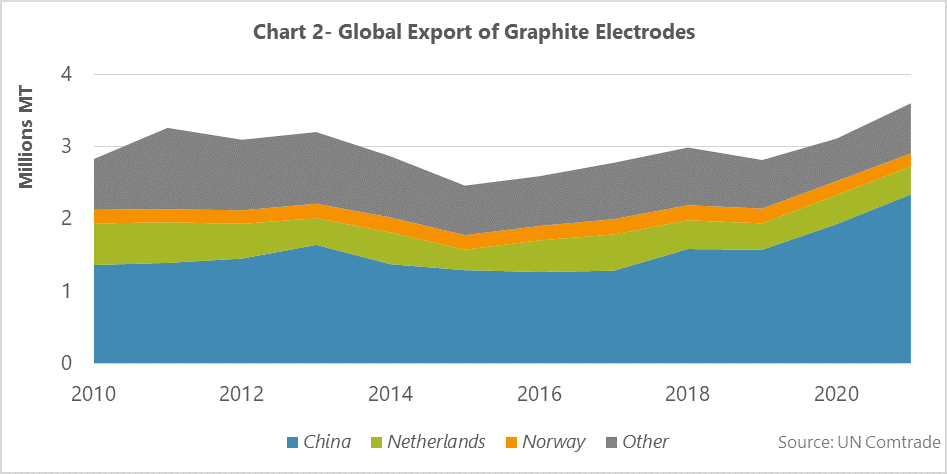

The global import and export volume of graphite electrodes was around 2.6Mt and 3.6Mt, respectively, in 2021 Iceland is the largest importer with an import share of 17% and China is the largest exporter of graphite electrodes with 65% of the market share.

The electrode is one of the main parts of the industry, which is able to pass electric current with minimal resistance, and having this feature has grabbed a lot of attention in the industry. This part is mainly used to transmit high current of electricity in EAF in the metal products, including steel and silicon metals, and the melting process in metal products factories.

The global trend of steel output is up warded, due to the use of graphite electrodes in its production, the market experienced a demand growth of electrodes. In addition, the product’s consumption caused the global upward trend of graphite electrodes, because they need to be substituted after being used for a certain time, the demand growth for steel is also expected to increase in construction, oil and gas, automotive industries, and the use of EAF. Moreover, it is expected that the growth of various industries such as aviation, electronics and packaging, which are consumers of graphite electrodes, will lead to the market improvement.

The global demand of graphite electrodes increase according to the forecast, its trade volume was also examined and presented in Figure 1 and 2 from 2010 to 2021. It should be noted that, the tariff code examined in this report is related to the total of graphite electrodes used in furnaces with code 854511 and electrical consumes with tariff code 854519.

Iceland, the largest importer of graphite electrodes

The global import volume of graphite electrodes was about 2.6Mt in 2021 according to the Figure 1, in which Iceland is known as the largest importer of graphite electrodes in the world, with a share of 17%. The Iceland’s imports increased by 0.27% annually, from around 428kt in 2010 to about 440kt in 2021. It is worth mentioning that 98% of Iceland’s imports were related to electrodes consumed in EAF for steelmaking. Since Iceland is one of the lead steelmakers, this is justified and besides that the Netherlands and Norway, each having 58% and 40% of Iceland’s market share, are its biggest importers.

After Iceland, the UAE and Norway, each with 12.6% and 11.3% of the import market share are in the second and third importers of graphite electrode in 2021. The imports volume of the UAE increased from around 184.5kt to about 332kt, with an annual growth of 5.5% over the timeframe, and that of Norway, with an annual growth of 4%, grow from around 195kt to about 298kt.

With 92% of the UAE market and 51% of the Norway’s market, China is the largest importer of these two countries. In addition, the growth of domestic demand in the electrical industry is one of the reasons for higher imports volume, so that around 97% of the UAE and Norway’s imports were related to graphite electrodes consumed for electrical applications.

Canada and Russia also have 11.2% and 9% of graphite electrode imports in the world, respectively, and are considered as the main importers. Canada’s import volume has increased by 4% annually, up from 196kt in 2010, to around 297kt in 2021, where about 90% of Canada’s imported electrodes are consumed for electrical applications and 10% for furnace. Furthermore, Russia’s imports has not experienced significant changes over the period, with an annual growth of around 0.07%, increased from about 242kt to around 244kt.

Steel, the main reason for import fluctuations

With the reduction of pressure caused by the global economic crisis in 2008 and the improvement of the situation of industrialized countries in the West and finally the steelmaking growth, the import volume of graphite has faced an upward trend of 250kt in 2010, according to the Figure 1. The electrodes import has had a steady trend from 2011 to 2015, but the global steelmaking has decreased significantly since 2015, due to the consumption drop and the competition growth in the international markets, of which the price fall of iron ore was one of the main reasons. This factor has affected the consumption and import of graphite electrodes and has led to a decrease of 285kt of the import volume, which has intensified in 2017 and 2018, as well as steelmaking growth in South African countries since 2016 has led to the higher imports volume in these two years. It has gone through a constant trend with small fluctuations that were the result of ups and downs in steelmaking industry from 2018 to 2021.

China, the largest exporter of graphite electrodes

The global export of graphite electrodes has increased from about 2.8Mt in 2010 to around 3.6Mt in 2021 with an annual growth of 2%, according to the Figure 2. With 65% of the market share, China is known as the largest global exporter of graphite electrodes, and its export volume surged from about 1.3Mt in 2010 to around 2.3Mt in 2021, with an annual growth of 5% over the timeframe. China’s flagship in graphite production is one of the main reasons for this, in which 82% of China’s exports were related to graphite electrodes consumed in electrical applications, of which Canada and the UAE are the largest export destinations.

After China, the Netherlands and Norway, each having 11% and 9% of the export market share are in the second and third place among graphite electrode exporters in 2021. The Netherlands’ imports volume has decreased by 3.5% annually, down from about 573kt in 2010 to around 386kt in 2021. It is worth noting that, almost half of the Netherlands’ exports were related to electrical consumption and half of it was related to furnaces, Norway and Iceland are the country’s main export destinations.

Norway’s exports also decreased by 0.5% annually, down from about 190kt to around 180kt, which was related to the export of graphite electrodes for electrical consumption, which were mainly exported to Iceland.

Electrode export, influenced by the steelmaking industry

As it mentioned earlier, with the reduction of the pressure caused by the economic crisis of 2008, the steelmaking and the trade of graphite electrodes has grown in 2010, besides the imports growth, it has led to an increase of 434kt in the export of graphite electrodes. The export of graphite electrodes has gone through a stable trend from 2011 to 2013, but the market has faced a fall of 740kt of exports from 2013 to 2015, which is similar to what has been said in the import section, the drop in the iron ore price has led to a decline in steelmaking and ultimately a trade drop in graphite electrodes. The export of graphite electrodes has experienced an upward trend from 2015 to 2021, the main reason for which is the global growth of steelmaking industry, towards production using the EAF method, which has led to a significant surge of global demand for graphite electrodes and ultimately higher global exports.