The analysis of China’s lead ingot production statistics in q2 2022 indicates a relatively significant growth in production y/y. Although the review of cumulative production statistics until the end of H1 2022, shows not significant difference in the production volume during the H1 of 2022 and 2021.

With the Covid-19 outbreak in March 2022, the increase in demand has occurred due to the lack of supplying goods following the consequences of the pandemic, and this caused the inventory to decrease by 4% in March, reached 4.4kt. Therefore, the production growth in May 2022 compared to 2021 was aimed at compensating the inventory drop in and meeting demand.

As many other metals, China is the largest consumer and largest producer of lead in the world. The high density of lead, low melting point, malleability, its reluctance to oxidation, the ability to absorb gamma rays and X-rays, and especially its flexibility and resistance to corrosion are among the features that lead to the widespread applications of this metal in China’s various industries and infrastructures such as the construction of water pipes (mainly non-potable) as well as the transfer of some chemical materials, the production industries of various types of batteries, cables, stainless steel, ceramics, and glass industry, building structures, gasoline, etc.

Paying attention to environmental issues regarding lead is one of the reasons that make the consumption face limitations. In addition, mining, smelting, and refining activities caused a significant increase in the level of lead metal in the environment, especially near mining sites, which has also created restrictions on the supply side, despite the limitations.

The production and consumption of lead in China is expected to increase over the coming years and with the country’s attention to environmental issues after passing through the period of economic boom, like many developed countries, including the US, which have banned the lead consumption in many industries such as paint, water transportation, gasoline, etc. it should be faced with a decrease since the end of the 19th century.

It is worth mentioning that today around 80% of lead consumption is in acid battery manufacturing industries. Due to the lack of lead consumption in the construction of electric and hybrid vehicles, gradually increasing the share of hybrid and electric cars in the global auto market and China’s entry into the market will lead to a decrease in lead consumption in the country.

As mentioned earlier, China is the global largest producer and consumer of lead, which covers about 50% of the lead mine production. However, due to the higher importance of environmental issues over the past years and especially after 2017, China had more control over the production and consumption of lead, and due to the polluting production processes, it has focused on importing a part of its domestic demand.

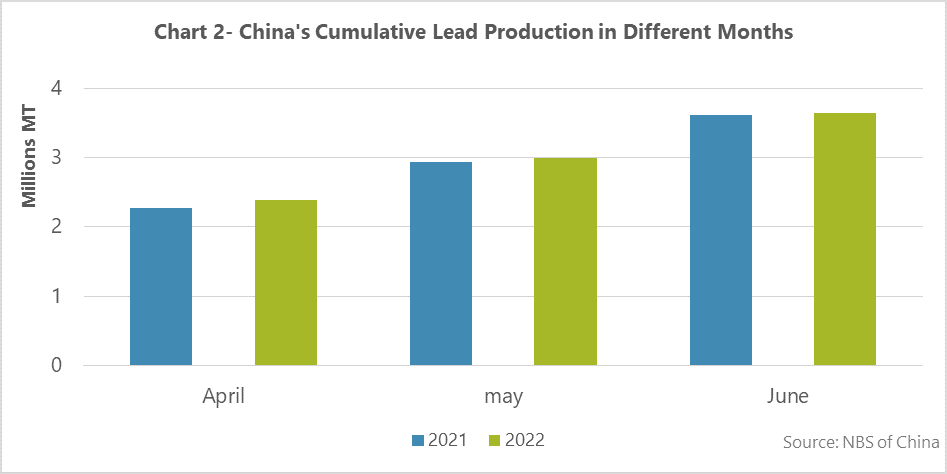

The investigation of China’s lead production in q2 2022 indicated the seasonal production growth y/y. However, the cumulative production of 2022 until the end of the H1 proves that the lead production in q1 of these two years was almost the same. This issue is partly caused by periodic inspectors and market developments.

China’s seasonal increase in lead production

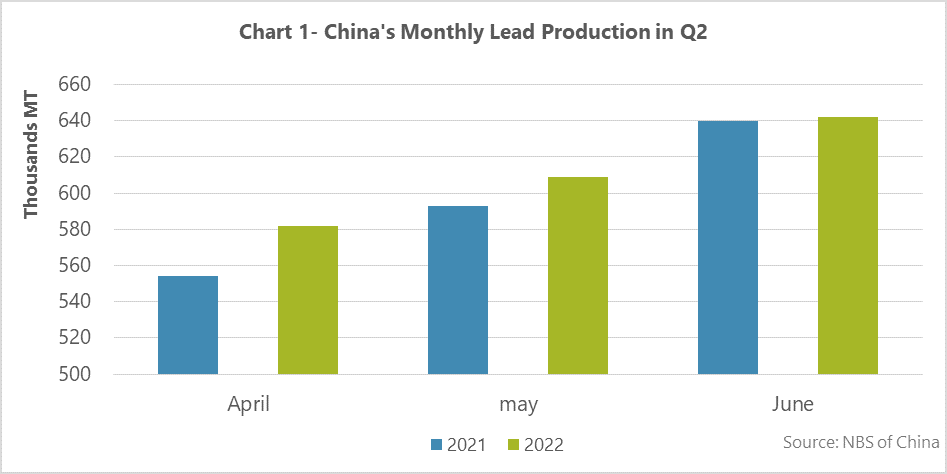

The trend of China’s lead production in q2 2021 and 2022 can be seen in Figure 1.

The upward trend of lead production volume is quite evident, according to the Figure 1 and by examining the output data in the months of April to June in 2021 and 2022. In all months of the q2 2022, lead production has increased compared to the previous year. So that an increase of about 30kt in April, around 15kt in May, and 2kt in June has been recorded. China produced around 1.8Mt of lead in q2 2022, up by about 45kt y/y.

The beginning of the maintenance in primary lead smelters was one of the reasons for lower production in April 2021, among which there were large factories such as Western Mining, Jinli, Yunnan Chihong, and other factories. Besides that, the second round of environmental protection inspection based in Hunan, Yunnan, and other areas has also started in this month. Consequently, the production of some small and medium scale factories has declined slightly. Therefore, it has caused the total primary lead production to be lower than expected in April 2021. The 7% production growth in May 2021 is due to the completion of the second round of environmental protection inspection in this month and the reduction of its impact on large primary lead factories, and on the other hand, the completion of the maintenance has led to the resumption of production.

It is worth noting that the annual maintenance have also been carried out in April 2022, and the production upturn in the following months is due to the completion of the maintenance in these months. However, reducing the impact of periodic environmental visits this year has led to the production growth compared to 2021.

In addition to the impact on the production of primary resources, environmental inspections have caused an unexpected decrease in production from secondary sources as well. Environmental protection inspection teams from various regions, including those in Shaanxi and Anhui, had an unexpected impact on refinery production controls, and refineries such as Hyunji were suspended in April. Put it another way, the lead price has decreased since the beginning of April; so that the supply of battery waste was limited and because of this the refineries face with a large production cuts.

China’s cumulative production of lead up to 3 months can be seen in Figure 2.

The cumulative production volume of lead in China was about 3.6Mt until the end of June in 2022, which has increased by over 135kt, up by around 4% y/y According to Figure 2. It should be noted that, the difference between cumulative production until the end of the H1 of the year is almost equivalent to the difference in production in q2 of the year, and this volume in the q1 2022 and 2021 was almost similar. This issue shows the existence of a specific plan for the lead production in China, with not much fluctuation. Because all the things mentioned in the report, including environmental issues, maintenance, and pandemic, ultimately had an effect of up to 4% on the total lead production of the country.