Alumina is a result of bauxite refining, and it’s consumed as the raw material for aluminum production. Alumina’s transportation cost is lower than bauxite transportation and has more economic efficiency, leading to the aluminum producer countries providing their requirement as the alumina and because of that this material is traded with a high volume in the world.

The presence of the biggest bauxite deposits in Brazil and Australia turned these two countries into the largest alumina exporters in the world. However, the import of alumina isn’t exclusive and many countries are its importer in the world, but the largest exporter destinations for it are Russia, Canada, and China. This coming year won’t be stunning for the global alumina trade because of the expensive energy in Europe due to the war between Ukraine and Russia, consequently the reduction in alumina production in the world and stopping the export of this material from Ukraine to Russia lead to the drop in its trade and makes an unclear future for this trade.

Alumina is the same as the aluminum oxide which is an amorphous solid, odorless, white, and neutral substance and it’s obtained from bauxite. Overall, this material can be produced by bayer method that known as the bauxite refining, too. Having lots of specific features in many applications, made this material to be worthy and valued. The main function of alumina is in alumina production; therefore, many aluminum producer countries are needful to this product. In addition, alumina transportation cost is highly lower than the transportation of bauxite; for instance, it need over 6 tonnes of bauxite to produce just 1 tonne of aluminum; while a tonne of aluminum can be produced only with 2 tonnes of alumina and this make a condition that the largest alumina exporters and sellers, be the largest bauxite producer, too.

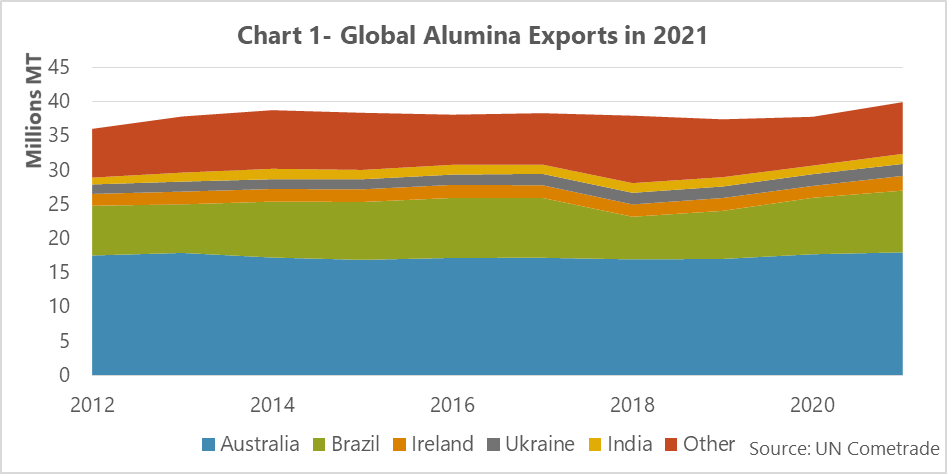

The vast applications of alumina in different industries make its trade to be facile and simple; therefore, a significant volume of alumina, about 18mt, is traded annually all over the world. Figure 1 is the result of surveys on the biggest import bases which shows more information about the global alumina market and its trade.

Australia’s significant effect on the global alumina market

As it’s showed in figure 1, the total global alumina export trend was gradual and upward in this period. Its export level has increased from 36mt in 2011 to 39mt in 2021 and during this time, the alumina export has faced a 0,8% growth. as a consequence of the depreciation in alumina price in the world in 2018, the export of this material decreased, as well, compared to 2017, the export level of this product fell by 1% globally which this change due to the increase in price in 2020, turned back to its upward trend and re correct its previous reduction.

As it’s been seen in figure 1, around 45% of the world’s alumina is exported from Australia. Because of being the owner of the enormous bauxite reserves and as the largest alumina producer in the world, this country has got the monopoly of alumina export in the world. Australia has been always the largest producer and exporter of alumina on a global scale, meanwhile, it’s known as the biggest bauxite producer, too. It has to be mentioned that during the worldwide reduction of alumina export due to the alumina price depreciation, this material export in Australia stayed steady and didn’t change too much.

After Australia, Brazil is considered the largest alumina exporter. However, Guinea is known as the biggest bauxite producer after Australia in the world, but the lack of necessary infrastructure in this country has prevented alumina production and of course its export.

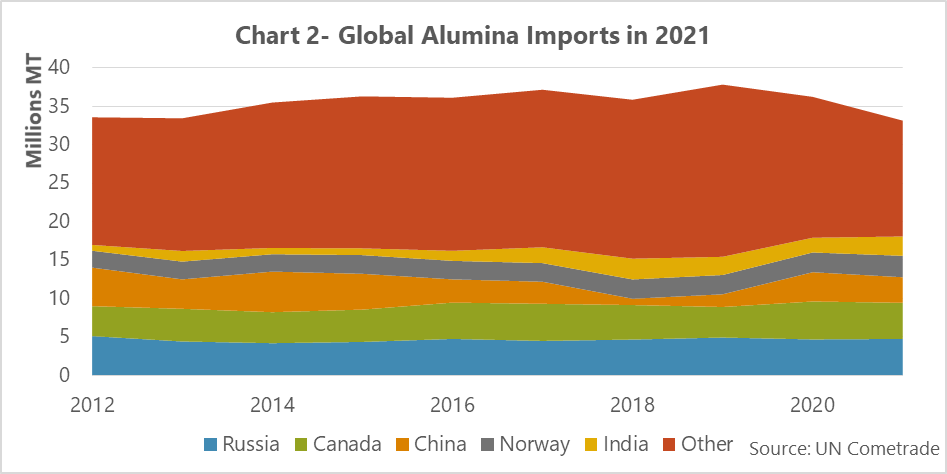

The alumina import on a global scale and the biggest export destinations from 2012 to 2021 have been indicated in figure 2. The general trend of alumina import was approximately steady in the world from 2012 to 2021. It’s nice to know that the difference in the global import with export of alumina is due to the errors in the countries’ customs. In the meantime, the countries’ share of this material import was fluctuating. The alumina import, unlike its export, isn’t exclusive, that’s why, many countries use alumina in their different industries; but the largest export destinations are Russia, Canada, and China. India is one of the biggest aluminum producers in the world, but its name is in the list of alumina importers, too. Even though China is the biggest consumer in the world, and by the reason of this fact that it’s known as the largest alumina producer, it is less dependent on imports than the other importing countries.

What’s waiting for the alumina market?

In 2021, Ukraine with a 36% of share in Russia’s alumina import market, Australia with a 31% share, and Ireland with a 10% share of this market, were the main alumina suppliers in Russia but after the war between Russia and Ukraine, this market lost Ukraine’s 36% share. On the other hand, the energy crisis in Europe which was caused by this war led to the reduction of alumina production and cast a shadow on the global alumina market and it became the reason for the reduction of the global alumina trade in the current year. With the continuation of this war, it seems that there is no bright future waiting for the alumina market in the world.