Russia, as one of LME copper supplier, plays a key role in the supply of European copper, and the sanctions imposed after Russia-Ukraine conflict and the lack of purchase from Russia’s producers have faced Europe with a copper deficit and the copper price increased to over $10,000/t over the period.

The geopolitical tensions between Russia and Ukraine, followed by growth of the US interest rates and other central banks due to the higher global inflation, increasing the copper price at a certain point. The surge in fuel price led to a growth in transportation cost and other production costs, which also had an effect on the higher price of commodities, including copper.

Political developments, especially in the case of the superpowers of the world, make the global economy and the commodity market through significant changes. The war between Russia and Ukraine is one of the examples. Russia’s position in Europe and its energy reserves caused the country to be the main producer and distributor of fuel and energy in the world. The application of comprehensive EU sanctions against Russia after the country’s military attack on Ukraine led to a ban on the purchase of energy and commodities from Russia. Russia is known as the main supplier of energy to Europe, and following the ban on energy imports from Russia, Europe experienced an energy crisis, in which the fuel and commodities price increased. The international nature of the new crisis in Europe and Russia had profound consequences on international relations in the future, especially in Europe and Asia, as well as the mining industry.

Russia’s copper market and its impact in Europe

In addition to energy, Russia is one of the largest suppliers and exporters of copper in the world. About 4% of the global refined copper is produced by the country, and considering that the consumption of refined copper is not high, therefore, the products are mainly exported in the form of concentrate or refined copper.

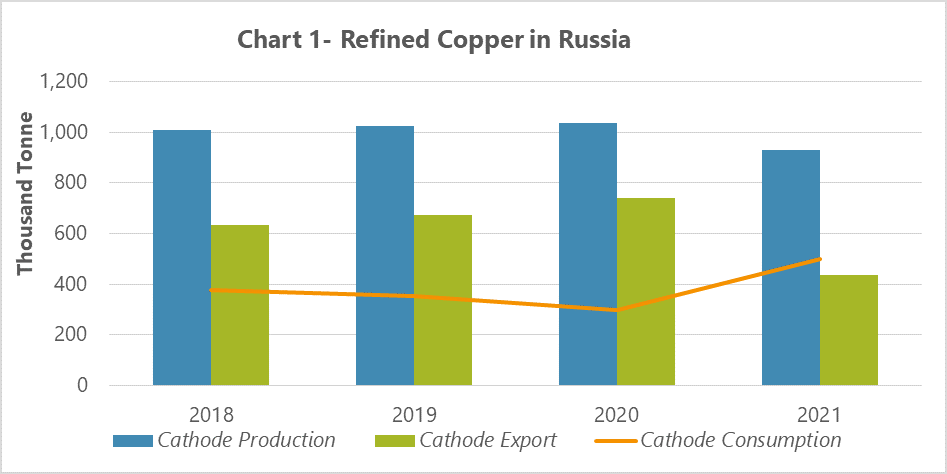

Chart 1 indicates the trend of refined copper market from 2018 to 2021. As it is clear in the graph, only 38% of refined copper produced in Russia was consumed domestically on average and the rest was exported over the timeframe. Russian copper cathode is mainly exported to Europe and its surplus is transferred to LME warehouses. It is worth mentioning that, the Netherlands and China are the main export sources of copper cathode for Russia, in which China’s share is increasing.

Russia has exported over 155kt of produced cathodes to China in 2021. This figure constitutes 36% of Russian copper cathode exports. Due to the inevitable role of Russia in copper supply in the region according to this graph, the country’s sanction as one of the copper suppliers not only caused a huge loss to Russia, but also changed the supplying cost at the regional level and even more on a global scale.

The Russia-Ukraine conflict and the sanctions imposed by the US and the EU against Russia caused extensive changes in the global copper trade market. The first effect was the demand drop for refined copper and Russia’s copper products in the world, followed by a decrease in the products’ export. Because Russia faced problems in customs clearance and export trend; besides, the production of copper smelters declined due to the oversupply of the domestic market.

Moreover, the role of Russia’s copper financing abroad was greatly reduced. Some banks stopped buying Russia’s copper cathode on credit, according to Bloomberg. This action led to a sharp drop in the import demand of Russian brands. According to SMM, some of the country’s copper cathode was transferred to LME warehouses for delivery. However, due to fewer containers and ships, the country’s copper trade was very limited during the conflict between Russia and Ukraine.

Finally, the conflict between Russia and Ukraine directly led to the reduction of the country’s copper cathode supply in Europe, and this was a driver for higher copper prices. The serious logistics problem in the Black Sea caused by Russia-Ukraine conflict prevented the refined copper export from Kazakhstan and Uzbekistan to Turkey, France, Great Britain and other European countries.

LME copper deficit due to Russia-Ukraine conflict

One of the main consequences of this war can be the decrease in cathodes sent from Asia and Europe due to the closure of waterways, sanctions against Russia and the lack of supply of copper sent from these areas to the warehouse of the LME, which was more than the cathode sent from other parts of the world to these warehouses, and this meant a supply deficit in the foreign markets and a decrease in LME warehouse inventory. The cathodes exported by Russia to Europe were stored in the LME warehouses after deducting the domestic consumption of Europe. Therefore, with the US and Europe sanctions against Russia, the copper inventory in the LME faced a deficit, and this led to copper price growth. It is important to mention that 3% of LME’s copper inventory was supplied by Russia.

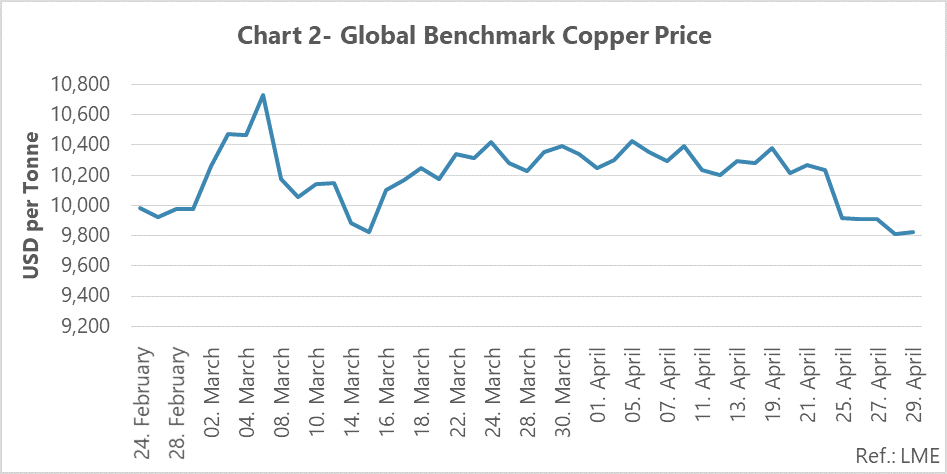

Chart 2 reflects the impact of the Ukraine-Russia conflict on the global copper price after the Russia attack on Ukraine (February 24, 2022) after one month. It is obvious that after the Russian attack on Ukraine in the q1 2022, a price jump was observed in the copper market according to Chart 2, and for the first time the global price of copper exceeded $10,000/t, which by the end of April (before the outbreak of Covid-19 in China) remained in the same price trend. Copper price hit a peak of $10,747/t in May, but since then, due to the economic recession of China and Covid-19 outbreak, as the largest consumer of metals, the copper price declined between $9,000 and $10,000.

It is worth mentioning that the price hike was created within two weeks, which is also evident in chart 2, that is not only due to a drop in copper supply; but also there were concerns about the global shortage of non-ferrous metal after the war, which greatly impact this price growth.

The effect of higher fuel price on copper

Since Russia is considered one of the main suppliers of fuel and energy in Europe, another effect of the country’s war with Ukraine, which has affected all industries production and has even become a wave of global inflation, the global growth of fuel and energy prices is caused by the sanctions against Russia. The higher energy prices led to growth of production cost, resulting in the global drop of commodities production.

Germany suffered more from the consequences of this war among other European countries. Germany supplied most of the energy to produce electricity from Russia’s natural gas, which, following the sanctions, caused this country to face major challenges in providing energy and fuel.

Geopolitical tensions between Russia and Ukraine, followed by interest rate hikes by the US government and other central banks to control the global inflation, leading to copper price growth. The surge in fuel price has led to a jump in transportation and other production costs, which has not had an effect on the commodities price, including copper.

Generally speaking, the unprecedented global inflation that occurred as a result of the Russia-Ukraine conflict and the sanctions imposed against Russia, not only caused the transport disruptions and increased commodity prices, but also led to a decrease in purchasing power of worldwide, weakening the various industries and the global copper industry as well.