Investment security and high profit margins have always attracted governments and public to gold trade. The high profit margin of gold production makes countries that have gold reserves seek to continue and increase production. Central banks are considered to be the main gold consumers as a financial support and people use it with the purpose of investment and ornamental.

The production and consumption of gold has increased y/y in 2021, which caused by the drop of pandemic disruption. China will continue to be the largest gold producer and consumer in the world in 2021. Overall, the production volume of mineral gold has increased by 3% y/y in 2021, and the consumption volume has increased significantly by 47%.

More than 3.58kt of mineral gold were produced by different countries in 2021, in which Africa has the highest share but European countries accounted for the lowest volume, according to the statistics published by WGC. Although African countries have a cumulative share of over 980t of mineral gold production in 2021, none of them alone have a place among the top 5 gold mineral producers.

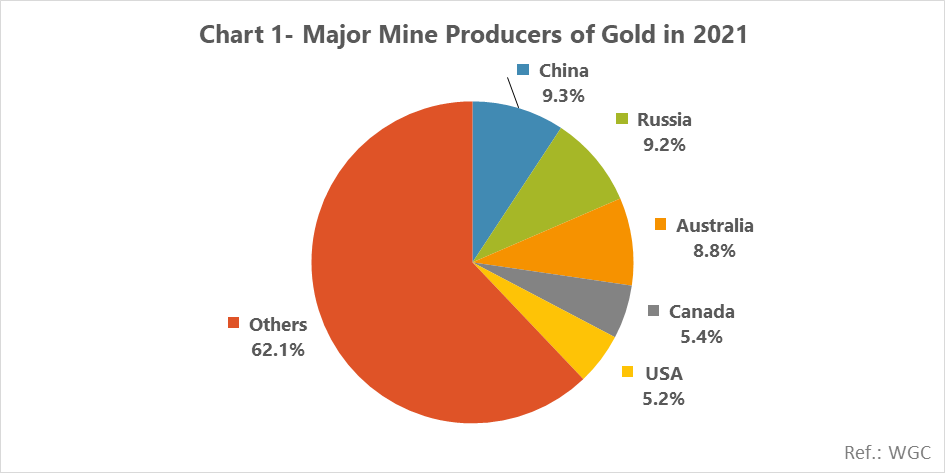

China, Russia, Australia, Canada, and the US have recorded the highest mineral production of gold in 2021, in which around 38% of the total production share is took over by these five countries. It is worth mentioning that, China, Russia, and Australia as the top 3 producers, provided the production of about 332t, 331t, and 315t, respectively, which had a significant difference compared to other producers in 2021. Figure 1 shows the share of top gold producers in 2021 from the total mineral production of the world.

In addition to the top 5 producers, Ghana, Peru, Mexico, Indonesia, South Africa, Uzbekistan, and Burkina Faso are also other countries that each have a share of over 100t of gold mineral production in 2021 and a significant share have taken over the production.

The total mineral production of global gold has increased by around 105t y/y in 2021. Meanwhile, the 5 largest producers, excluding Canada, have all faced a production drop compared to 2020. The production of China, Russia, Australia, and the US has decreased by a total of 57t y/y in 2021, but by increasing its production level to about 20t, Canada has occupied the position of the US as the fourth top producer of mineral gold.

It should be noted that, the production volume of China, the largest producer of mineral gold, has decreased by over 36t y/y in 2021. In general, the mineral gold production with about 464t, has experienced a downward trend in China since 2016. The main reason for production cuts in China is due to the decrease in grade of remaining reserves and the increase in environmental strictures, which has led to the closure of some mines, especially small-scale mines in the country.

Peru, Mexico, Indonesia, and South Africa, which were the seventh to tenth largest gold mineral producers in 2021, respectively, had a total growth of about 68t y/y in production and had a positive effect on the production hike. Considering the significant share of other countries in gold mineral production, it is possible to distribute gold production in different continents and countries. The lacking complex technology, along with the profit margin and appropriate value added, has caused all the countries with reserves to mine and process gold.

Significant growth of gold consumption in 2021

Investment security is one of the reasons that make investment funds, the public and central banks invest in the gold market and increase the demand as well. Especially, when the US dollar has experienced many ups and downs in the world over the recent years, and gold has proven its risk in the field of investment.

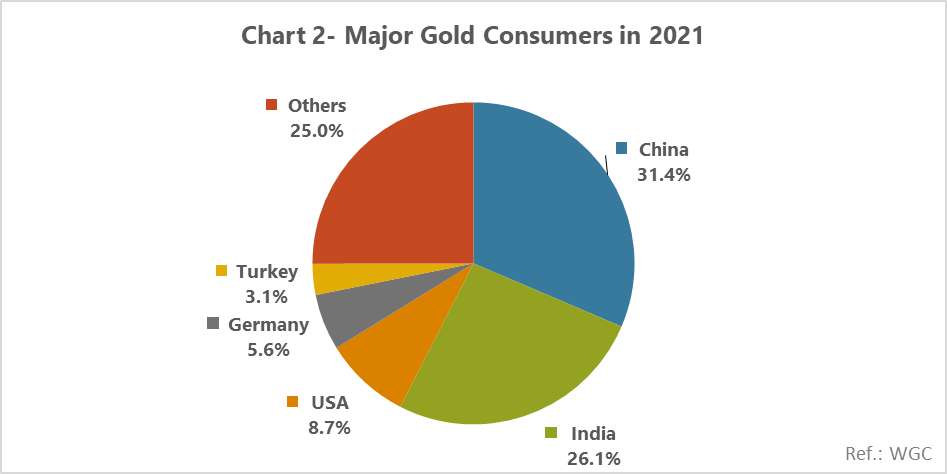

Gold consumption in different countries is generally analyzed from the consumption level of jewelry, bullion, and investment coins. Gold consumption is estimated to be over 3kt in 2021, up by 1kt y/y. China, India, the US, Germany, and Turkey have been the global largest consumers of gold, respectively, in 2021, as well as the last year.

China and the US in addition to significant mineral producers, are among the main consumers of gold. Especially China, which is both the largest producer and consumer of gold in the world. Among the 5 largest consumers of gold in 2021, excluding Turkey, gold consumption by other large consumers has increased y/y.

One of the main reasons for this is the significant demand growth from the central banks of most countries in 2021 compared to the last year. Moreover, the pandemic reduction has led to an increase in holding of ceremonies and celebrations in various countries in 2021, as a result of which the demand volume of jewelry and gold consumption has increased significantly. Figure 2 shows the share of major gold consumers in relation to the total gold consumed globally in 2021.

The distribution of gold consumption is far more concentrated than that of its supply, as in Figure 2. Therefore, the 5 largest gold consumers have taken a total share of 55% of the global gold consumption in 2021. Meanwhile, China and India have consumed around 58% of the global gold this year. Iran, which is the sixth largest consumer of gold in 2021 after Turkey with about 52t, has registered a share of 1.7% of the total consumption.

Gold consumption in China and India in 2021 compared to 2020 has increased by 57 and 79 percent, respectively, and has increased by nearly 700 tons compared to the previous year. As mentioned earlier, the removal of restrictions or reduction of caused by Covid-19 during 2021 was the main reason for this. Especially in India, where the consumption of jewelry has cultural and historical roots, with the pandemic disruption and the formation of a new wave of wedding ceremonies and various festivals in 2021, the demand for gold has increased significantly.

According to what was mentioned earlier, the main gold consumption is in the investment and jewelry making sector, and the consumption in the industry is insignificant compared to the other two sectors. However, in general, the gold consumption in industrialized countries, especially those with high-tech industries, can be significant. Furthermore, the gold consumption in industrial sector in developed countries is about 10% of the total volume on average.