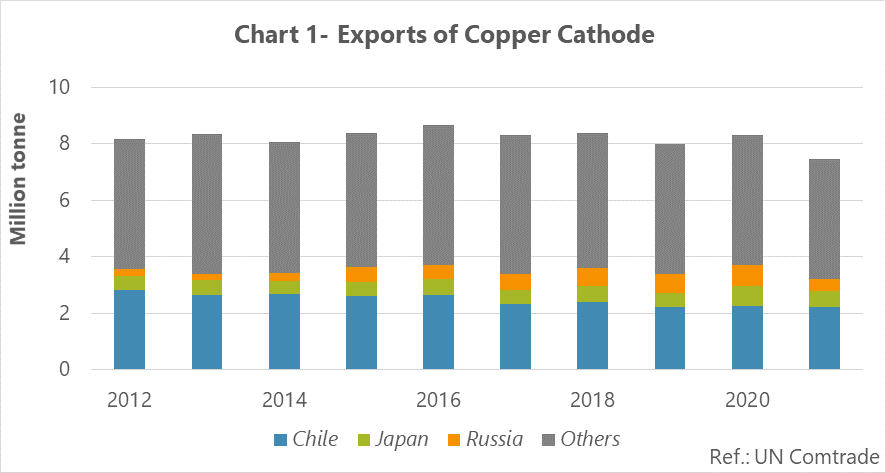

Chile has maintained its first position in the global market of copper upstream product, such as copper cathodes over the past 10 years, and has accounted for a share of 30%. But despite the greater prosperity of the copper trade, the global growth rate of Chile’s export share decreased.

Chile, Japan, and Russia are among the main copper cathode exporters in the world. These 3 countries accounted for about 43% of these upstream copper products in the global total export market on average, over the past 10 years.

In addition to being widely used in wire, cable and transformer industries, copper metal is also used in transportation, electrical appliances and machinery, defense equipment, and construction. Copper cathodes are the major primary raw material for the production of high purity copper products and are used for copper alloys. Copper cathodes are consumed to produce alloys such as brass, bronze, and alloy steel. Copper cathodes have various types that differ in the impurities volume in their composition, according to the GOST 859 standard; aluminum, bismuth, and oxygen can be mentioned among these impurities.

Chile ranks first in copper cathode exports

Chile, Japan, and Russia were the main global exporters of copper cathode over the past 10 years. The average export volume of these countries was about 2.48Mt, 538kt, and 479kt, respectively. Therefore, Chile ranks first in the global exports by a very high margin. The existence of rich copper reserves in the country is one of the reasons for this, so that Chile is considered as the largest global copper producer. The share of Chile’s exports in the total global trade was 30%in 2021 with a tonnage of 23221Mt, while it was estimated at 34% in 2012 with an export volume of 2.806Mt. The production cuts due to labor disturbances and strikes was one of the reasons for Chile’s exports drop in 2021. Moreover, with the greater prosperity of copper trade and the lack of growth in Chile’s exports, the country’s share has gradually decreased.

Japan is also one of the rare countries that is considered to be the largest producer and exporter of copper cathode in the world, despite not benefiting from copper reserves. The global export share of Japan was reported with a volume of about 558kt in 20221 equal to 7%, while this share was 6% and the export volume was around 512kt in 2012. The growth and development of copper smelting and refining industry in Japan was due to the strong economy of Japan and the excellent level of trade relations for purchase of concentrate over the past 10 years.

Finally, the total exports share of Russia in the world was 6% in 2021, with a tonnage of 434kt while this amount was estimated in 2012 with an export volume of 241kt at 3%. Russia’s government increased the export tax for the iron products and some base metal products, including copper, based on Atubis research in 2021, and this led to a drop of 3 percentage points in the export volume y/y. Figure 1 indicates the exports volume of copper cathode in the studied countries.

China was the main export destination

China and the US, with an average total import of about 1.5mt of copper cathode from Chile, are among the major export destinations of the country. On the other hand, the share of Chile in supplying the import market of China and the US was estimated to be 33% and 60%, respectively, over the past 10 years. Besides that, China is one of Japan’s export destinations with an average share of 42%. India was the second export market of Japan, which had a significant growth in copper cathodes import since 2019 due to the pace of population growth and higher demand for copper products. Japan’s supplying share of the country’s import demand was 44% on average. In addition, China is the main export market of Russia, with an average share 4% in China’s import market over the period. This amount was 11% in 2021, up by about 2 percentage points compared to the previous year. Also, in the competition among exporting countries to supply China’s import market in 2021, Japan with a value equal to $9,259/t has a greater chance of taking over the market than Chile and Russia with a value of $9,280/t and $9,382/t. The main global export destinations of copper cathodes are shown in Figure 2.

The major importers of copper cathodes are China and the US. The total import volume of these countries was around 4.8Mt on average over the timeframe, a large share of this import belonged to China, making it the largest copper cathode importer in the world, and the US ranked second as well. One of the reasons for the import volume growth of copper cathodes in China is the high economic surge and, as a result, the improvement of industries such as construction, infrastructure, and transportation, which has increased the demand for copper upstream product and boost imports. Furthermore, due to the existence of at least 30 copper mines belonging to China in Africa and other parts of the world, the amount of copper concentrate imports to the country will grow. With the decision to revive and rebuild infrastructure in the US, the demand for copper cathodes has increased and led to more imports of the product in 2021. What’s more, India, which was one of the export destinations of the product, ranked 13th among the global importers with an average import of 63kt. It is worth mentioning that, India’s import of copper cathode increased 86% y/y in 2013, and it continued the upward trend until 2020. This is due to the average growth of 8% of the country’s economy over the period, and the economic growth caused the product’s demand growth. However, due to the Covid-19 hike and higher inflationary pressure in 2021, the demand for copper cathodes decreased and the imports volume dropped by around 3% y/y.

In general, the imports share of China’s copper cathode, with an import about 3.4Mt, was estimated to be around 46% of its total global trade in 2021. The US also had a share of 12% of this trade with an imports volume of 907kt this year. India with the import volume of 141kt in 2021, took a share of 2%.

Outlook

The demand for copper and its products is expected to grow over the coming years as the world moves away from carbon, focuses on solar electricity, and the rapid development of fuel and renewable energies. Moreover, due to the high rate of economic growth in China and India and the improvement of various industries compared to the US, the demand for copper cathode, which is the raw material of copper products, is expected to increase and the import trend will also be up warded. This imports outlook would be more likely in India, as the country’s copper ore reserves are limited.