Global chromium production has gone through an upward trend during the last 5 years. The average of its global production was around 38,4mt in 2017-21 and has increased by 7% annually. Chromium is an important element for stainless steel production. Most of this kind of steel contains 18% of chromium.

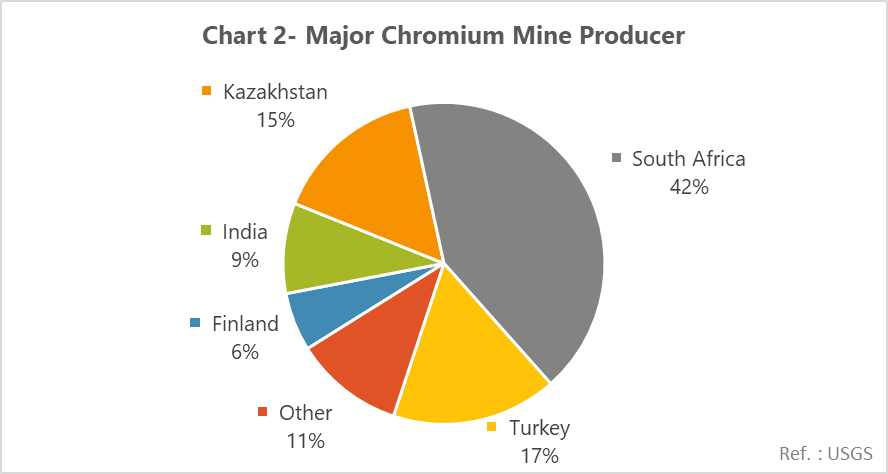

The largest chromium producers were South Africa producing 18mt, Turkiye and Kazakhstan with 7mt chromium production, and Finland with 2,3mt in 2021, and China, as the largest consumer, has imported the highest amount of chromium from South Africa.

Chromium is a brittle, shiny, and hard element. Chromite which is an iron chromium oxide (FeCr204) is the only ore that chromium can be produced from it. This element is the main additive in stainless steel production which causes its anti-corrosion property. Due to this fact that chromium is a metal that has a high polish ability and resistance to tarnishing, it is a remarkable element.

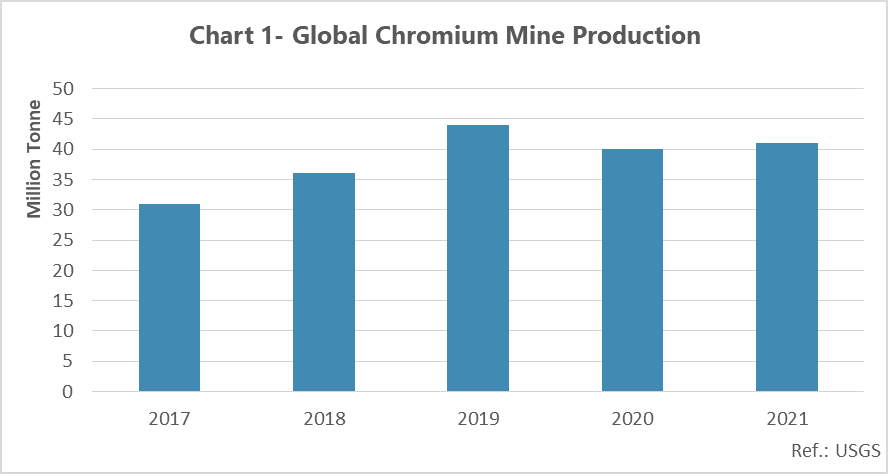

Figure 1 is the result of research about the amount of chromium production in 2017-21. The worldwide chromium production amount was around 41mt in 2021 which has increased by 10mt compared to 2017. Chromium production in 2020 has been 40mt which decreased by 4mt due to Covid-19.

In 2019 when Turkiye and Finland increased their production, the highest global production occurred and reached 44mt which increased by 22% compared to 2018 which was 36mt. On the other hand, the lowest amount which is 31mt, was recorded in the first research year in 2017.

The global production and consumption of chromium have passed an upward trend in companies with the increasing trend of all mineral products. Chromium is dealt in the forms of ferrochromium, iron alloy, and pure chromium in the global market. China is the largest ferrochrome and stainless steel producer, but it doesn’t produce chromium. Due to the large production of stainless steel, this country turned into the biggest global chromium consumer, also, China has known as the largest chromium importer with a 14,9mt import of chromium in 2021, as well. The consumption of chromium has faced growth because of the increase in steel consumer industries and the development of the stainless steel industry, too.

The import statistics of different countries such as Indonesia with 501kt, Russia with an import of about 442kt, 252kt import in India, and the import of 167kt chromium in UAE indicate the growth in consumption and demands of chromium and the increase in the stainless steel production. According to the report of the international steel association, the production of stainless steel in 2018 with 5,5% growth compared to 2017, reached 50,7mt. The statistics of the world’s biggest chromium importers show that they are the biggest consumer of chromium, too; that’s why many of these countries aren’t domestic chromium producers. Also, these statistics can show the huge difference between consumption in china with other countries.

It’s predicted that chromium prices will increase due to the increase in energy costs in 2023. In 2021, chromium ore production with 3% growth compared to the last year, reached 41mt and the essential reason for this growth was the market improvement after Covid19 pandemic. An important point regarding the future trend of the global chromium market is the application of stricter environmental standards in coming years in China, as the biggest consumer, which can affect ferrochrome and stainless steel production and lead to the reduction in alloy production prices that could stop the chromium market growth.

A significant growth in Turkiye’s chromium production

There are the largest chromium-producing countries in figure 2. South Africa with a 42% share, allocated the highest amount of chromium production to itself. Turkiye’s 17% share of chromium production, a 16% share of Kazakhstan, a 9% share of India, and Finland with having 6% share, filled the other ranks.

As it’s said, South Africa is the largest global chromium producer with a high difference; the average of this country’s production was around 16,4mt in this period of time. The production volume in this country during 2018-20 was equal and it was about 16mt of chromium. South Africa’s production in 2017-21 has gone through an upward trend and its the lowest production volume was 15mt, in 2017.

One of the largest reserves in South Africa which has a great effect on this country’s production is Dwarsrivier, the biggest mine in the north-east of South Africa with an estimated 55mt ore deposit and 21mt chromium also can be pointed to THABA with a 23,6mt deposit of chromite, this mine is one of the open-pit mines in South Africa; these two mines can cover a remarkable part of this country’s production.

The second chromium-producing country is Turkiye. On average and with a 3% growth rate, this country reached from 2,8mt in 2017 to 7mt in 2021 and has increased its production significantly. Etikrom is the largest chromium ore producer in Turkiye. The other large mine in this country is Yildirim. In 2019, Turkiye has produced 10mt. Turkiye’s steel market strengthening can be one of the most important factors for this country’s focus on chromium production to produce stainless steel.

The chromium production amount has gone through an upward trend in Kazakhstan in recent years; Vokshod is the largest mine in this country that produces 6,7mt of chromium. Donskoy, the mining and processing ore plate, Aktob, the ferroalloy plate, and the other ferroalloy plate is Aksu, and the mining company Kazmarganets are the four mining poles that supply the majority of chromium ore in Kazakhstan. India hasn’t gone through a, rising trend these years and by 2% reduction, reached from 3,2% in 2017 to 3mt in 2021 and its highest chromium production was 4,1mt in 2019.