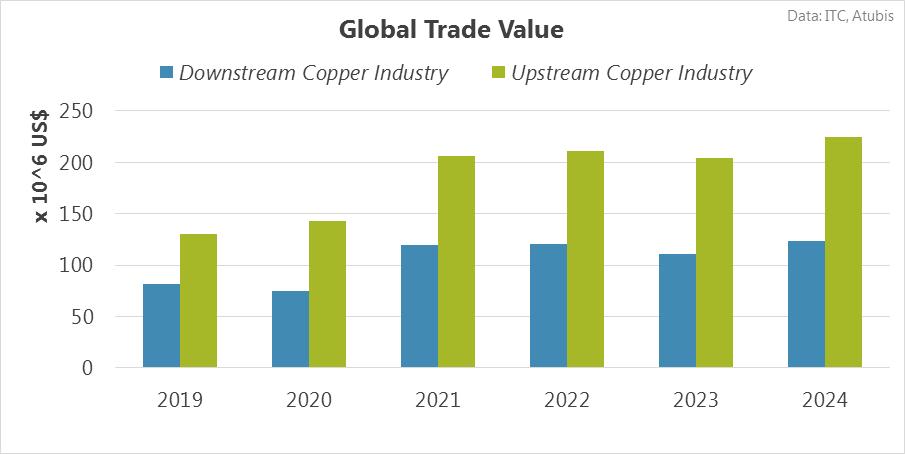

From 2019 to 2024, the Downstream Copper Industry grew steadily from about USD 81.9 million to USD 123 million, while the Upstream Copper Industry expanded faster, rising from USD 130 million to USD 225 million. Downstream reached its lowest point in 2020 and upstream in 2019, but both hit their highest levels in 2024. Over time, downstream moved from medium upward trends with normal volatility to slight declines and then slight recoveries with limited volatility; upstream showed a similar late-period pattern. In 2024, downstream and upstream values rose by 11.0% and 10.0%, respectively. Overall, the two industries showed a very good correlation and moved in the same direction during the entire period.

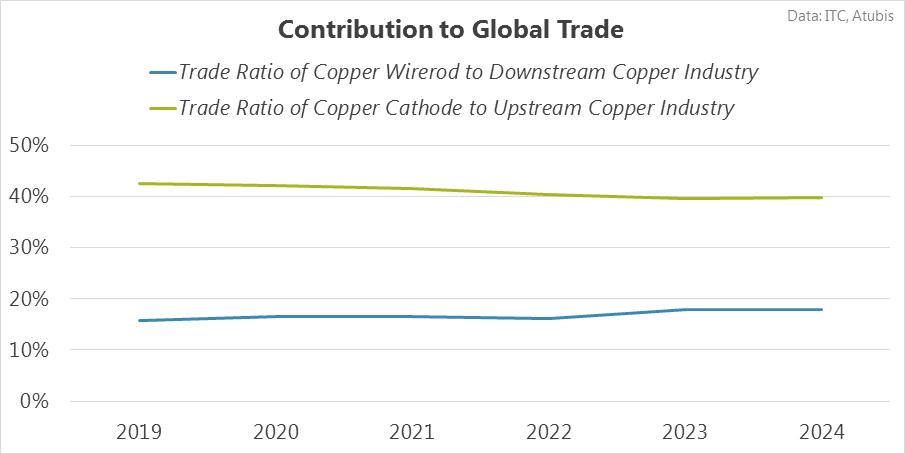

From 2019 to 2024, the two trade ratios in the copper value chain moved in clearly different directions, even though they were strongly connected. The ratio of Copper Wirerod trade to the Downstream Copper Industry gradually increased from 15.7% to about 18.0%, gaining roughly 2.3 percentage points, while the ratio of Copper Cathode trade to the Upstream Copper Industry slipped from 42.6% to nearly 39.8%, losing around 2.8 percentage points. The Wirerod ratio experienced its lowest level in 2019 and its highest in 2024, whereas the Cathode ratio showed the opposite pattern, with its peak in 2019 and its floor in 2023. Over the four analytical periods, the Wirerod ratio shifted between slight upward and slight downward movements, though always with low volatility, while the Cathode ratio followed a steady path of slight downward movement, also with low volatility. By 2024, the Wirerod ratio rose a bit—by 0.1 percentage point—to a level that was almost unexpected compared to earlier years, whereas the Cathode ratio climbed by 0.2 percentage point in a way that was completely in line with its past behavior. Despite moving in opposite directions, the two ratios still showed a very good relationship, suggesting that shifts in downstream wirerod trade and upstream cathode trade are closely linked, even when their directions diverge.

From 2019 to 2024, Copper Wirerod played a smaller role in global downstream copper trade than Copper Cathode did in upstream trade, mainly because cathode held the higher position in more years. The chart clearly shows that Copper Cathode stayed consistently stronger and more influential across the six-year period. On average, wirerod made up about 16.5% of downstream copper trade, while cathode accounted for around 40.9% in upstream markets, highlighting cathode’s significantly larger impact. Throughout the entire period, wirerod never exceeded cathode’s position, and Copper Cathode continuously remained at the top within global upstream copper trade.