Molybdenum concentrate is used as a raw material in various industries including steel and alloying, and it is particularly used in the production of alloys required by the aviation industry, as well as iron casting, including steel sheet, rebar, and steel pipes.

Chile with the help of 31% share in export of molybdenum concentrate in 2021, turned to the largest molybdenum in the whole world which Japan and South Korea are this country’s key export destination. And the largest importer of molybdenum is china with 14% share of the global imports and Chile is its main imported origin.

Molybdenum is considered one of the most important mineral elements in the world which is obtained through the concentration of molybdenite mineral extracted from mines, as well as the concentration of copper ore and the production of molybdenum concentrate, as a by-product of copper concentration units among the methods of economic extraction of this product.

Molybdenum concentrate is used as a raw material in various industries including chemical, oil and electronics industries; but the steel and alloy industry is known as the most important consumer industry of this mineral; so that its main use is in the alloying industry to make stainless steels, metals used in the aviation industry and special alloys for making airplanes; also, considering that the resistance of molybdenum against heat corrosion is very high, it is used to make cast irons and super alloys that have high hardness against rust. Among these items, we can mention steel sheet, steel rebar and steel pipe in different sizes.

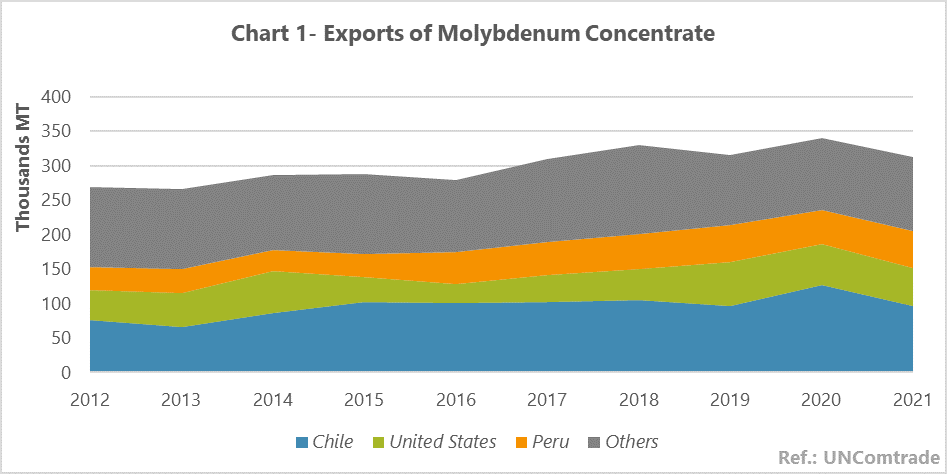

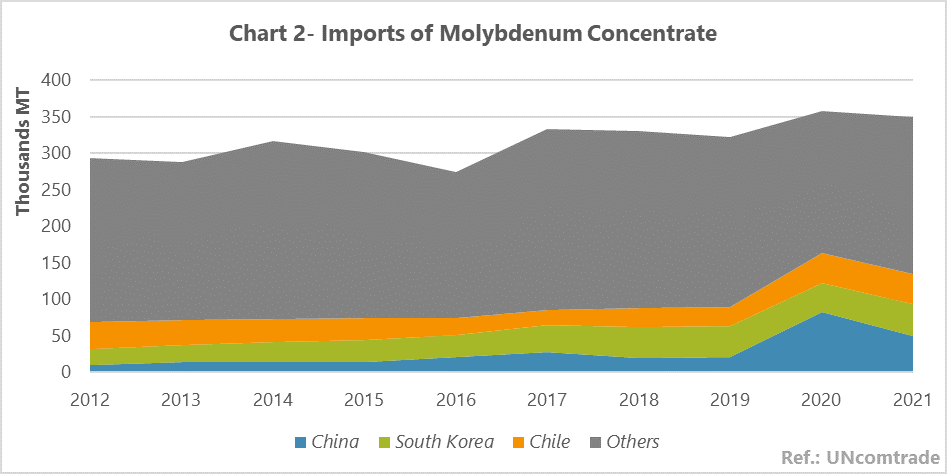

As it’s been mentioned, the widespread use of molybdenum concentrate in various industries has caused this metal to be noticed in industrialized countries; therefore, in this report, the amount of its trade in the years 2012-21 was examined in the world and presented in figures 1 and 2. It should be said that tariff code 2613 was used to investigate the trade of molybdenum concentrate; it is also important to mention that one of the reasons for the difference between the global import and export trend of molybdenum concentrate in the years under review is undoubtedly the failure to record some statistics and figures related to trade by some countries, as well as statistical errors.

Chile, the largest molybdenum concentrate exporter

As it’s indicated in figure 1, the export volume of molybdenum concentrate with 2% annual growth, has reached from 270kt in 2012 to 310kt in 2021 in the world and Chile due to have 31% share in the export is known as the largest exporter. This country’s export volume with 3% annual growth in the mentioned period, reached from 76kt to 96kt and countries like Japan and South Korea were its export destinations in 2021.

As it mentioned at the beginning of the report, one of the economical way to molybdenum concentrate production in the world is its production as a by-products in copper mines; due to this fact that Chile is famous as the largest world mineral copper, therefore, the production volume of molybdenum concentrate is high in this country and considering published data by Geological Survey, the USA is the world’s second molybdenum concentrate and considering the low consumption of this country and the reasonable profit from the export of molybdenum concentrate, it exports most of its products to other countries.

After Chile, America and Peru are in the next ranks in the world’s molybdenum concentrate exporters with the help of 18% and 17% shares respectively which the USA export volume with 3% annual growth over the investigated period reached from 44kt to 55kt and Netherlands has been the key export destination of this country; also, Peru’s export with 6% annual increase has reached from 33kt to 54kt in the mentioned period and its largest export destinations are Chile and the USA.

It is important to mention that according to the information available from the US Geological Survey, in addition to Chile, America and Peru also have rich molybdenum reserves and are also in the list of top molybdenum mineral producing countries which has led to the mentioned countries have a major share of molybdenum concentrate exports in the world.

As the figure 1 indicates, the world’s molybdenum export had encountered small ups and downs over 2012-21, but overall, has gone through an upward trend which shows the growth of mineral molybdenum production in countries with rich molybdenum resources, including Chile, the United States, and Peru, and the growth of consumption in major molybdenum consuming countries in the years under review.

China, the largest molybdenum concentrate importer

According to chart 2, the volume of molybdenum concentrate imports in the world, with 2% annual growth, from about 293kt in 2012 has reached about 350kt in 2021 which China with having 14% of the import share is known to be the largest importer of molybdenum concentrate in the world, with an annual growth of 19% in the mentioned period, from 10kt to 50kt, with Chile being the largest import source in 2021.

It’s worth noting that over 50% of the world’s molybdenum reserves are owned by China and it’s counted as the largest producer of molybdenum, but this country’s share of the world’s steel manufacturing leads to be the largest molybdenum consumer as well which cause china’s high molybdenum import.

South Korea is on the list of the world’s superior steel manufacturers; so as it’s said before, due to the fact that the steel industry is the largest molybdenum consuming, this country with has a 13% share of imports is known as the second large importer which with an 8% annual growth, reaches from 21kt to 44kt and its main exporter was Chile in 2021.

According to Figure 2, the world’s molybdenum concentrate import has faced many ups and downs which the world’s steel industry’s vacillation was its main reason; in a way that over 2014-16 the import of this product encountered a 40kt drop in the world that the financial instability of steel companies at that time and the decrease in demand and production in the steel industry in the world were the main reasons. In addition, a decrease in part of China’s export leads to a drop in imports and as the result decrease in consuming of China’s domestic products over this time which causes a decrease in molybdenum trade in the world.