During the last 10 years, China has promoted its position in the world’s wire rod market and it could increase its own share to 48%. Even so, the high speed of economic growth made more development of China’s share in the global wire rod demands.

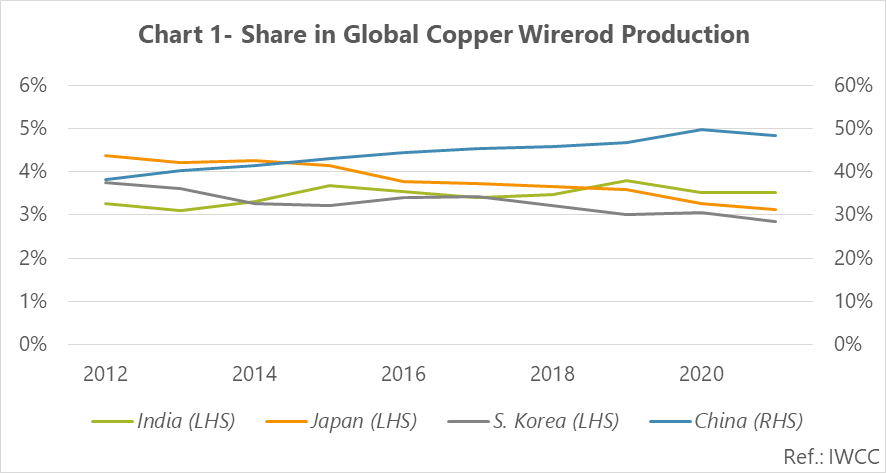

China, India, Japan, and South Korea are 4 countries that are considered to be the most important semi-fabricated copper producers that during the last 10 years, on average, have produced near to 55% of the world’s wire rod. Meanwhile, China and India’s shares increased, while the other 2 countries lost their share in this market.

A wire rod or wire is a single-strand wire and it’s made of copper. This product despite the heat and electricity transmission ability, are soft, flexible, strong, and resistant. Wire rod is used in electricity production, power transmission, power distribution, telecommunication, electronic circuits, and countless types of electronic equipment. Also, due to the wire rod’s characteristics, it’s used a lot in the construction industry and all these features are from its main and central core which is copper. Almost half of the mined copper is used to produce electric wires and wire rods.

The wire rod production trend in the world increased from 15,268 mt to 18,009kt from 2012 to 2019. But in 2020, Covid19 pandemic lead to a decrease in wire rod production trend and it reached 17,512 mt. In 2021, this trend with 5% growth, reached 18,472 mt. Also, the average of global production has been estimated at 17,115 mt during the last 10 years. Figure 1 indicates the share of China, India, Japan, and wire rod production.

Rapid growth in development of China’s wire rod production market

Rapid growth in development of China’s wire rod production market

In 2012, China allocated a 38% share of wire rod production to itself, and by 2020, it increased its production trend and owned 50% of the whole world production market. But in 2021, the production growth of other countries leads to a drop in China’s share and reached 48% which shows a 2% decrease. During the last 10 years, China’s average share of the world’s wire rod production has been estimated at 44%. India has got a kind of stable trend in wire rod production which is equal to 30% of the world’s total production, as well. The average of India’s share in the world’s total production during the past period was 30%.

Japan allocated almost 40% of the world’s total production, from 2012 to 2019, and then in 2020 and 2021 with 10% reduction rather than 2019, had a 30% share. Generally, from 2012 to 2021, the average Japan’s share of the world’s total wire rod production has been estimated at 40%.

South Korea in 2012 and 2013, had a 40% share of the world’s total wire rod production; and then its production trend was almost stable from 2014 to 2021 and reduce to 30% rather to 2012 and 2013. As well, average South Korea’s share has been reported 30% of the world’s total wire rod production.

In 2012, China’s wire rod export volume was 2,559 tonnes then since 2013 this volume increased sharply and reached 16,556 tonnes. This growth trend remained until 2016, but in 2017 with a 10% drop, export volume decreased from 21,430 tonnes to 19,302 tonnes. From 2018 to 2020, China’s wire rod export increased again, so that, it reached from 20,863 tonnes in 2018 to 29,571 tonnes in 2020. But in 2021 China faced a little drop and decreased to 28,225 tonnes. During the last 10 years, the average of China’s wire rod export was reported at 18,509 tonnes. The Philippines, Thailand, Vietnam, and Malaysia were the essential destinations for China’s wire rods.

India’s wire rod export volume was 2,817 tonnes in 2012 and until 2014 was fluctuating. But in 2015, this export volume ramped up from 5,220 tonnes and reached to 15,647 tonnes. After this year and until 2019, it encountered a deduction that the volume of export reached 2,327 tonnes. From 2020, the growth was seen again in India’s wire rod export volume and it reached from 5,463 tonnes to 10,091 tonnes in 2021. Also, the average of India’s wire rod export during the last 10 years has been estimated at 10,892 tonnes. And the important destinations for this India’s product were: Qatar and Sri Lanka.

In 2012, the amount of Japan’s wire rod export was equal to 13,782 tonnes and this amount was not stable and had ups and downs till 2020. Until 2021 when the export volume of this product reached 17,513 tonnes which means it had a 1,8% growth. Also, the average wire rod export in Japan during previous years was reported at 18,700 tonnes, and India, Thailand, and Vietnam are counted as important destinations for Japan’s export.

South Korea has exported 44,559 tonnes of the wire rods to other countries. This country’s exports have experienced many ups and downs during the last 10 years and in 2021, the export amount was 50,868 tonnes which had a 3,6% drop rather to the same amount in 2020. Also, during this period, the average of wire rod was export reported at 56,898 tonnes. The Philippines, China, India, and the USA are 4 important destinations for South Korea’s wire rod.

Generally, in 2021, South Korea, China, Japan, and India allocated ranks that respectively are 12th, 20th, 23rd, and 26th among all exporters in the world so that the total exports of the mentioned countries were equal to 106,697 tonnes in 2021 which shows 1,6% growth rather to 2020.

Thailand and the Philippines were the most essential export destinations.

Philippines is known as the most remarkable wire rod export market for China and South Korea. Purchase of wire rod in Philippines mostly was from South Korea rather than China. The reports show that during the last 10 years, South Korea’s average export share to Philippines was 45% while this amount for china was just 25%. From 2012 to 2015, China’s share was more than South Korea’s share in Philippines’ import market. However, from 2016 to 2021, South Korea supplied wire rod in Philippines market with a lower price rather than China; so that in 2021, South Korea’s wire rod price was US$1,294 while US$1,314 was the reported price for China’s wire rod.

The most important export destination for China and Japan’s wire rod is Thailand where on average; its share from China’s export has been estimated at 28% during the last 10 years; while this share from Japan was 14%. From 2012 to 2020, China’s wire rod price was lower than Japan’s, so it could allocate more shares to itself in the Thailand market. But in 2021, this price for both countries were close to each other, but still China had more chance for trading in this market.

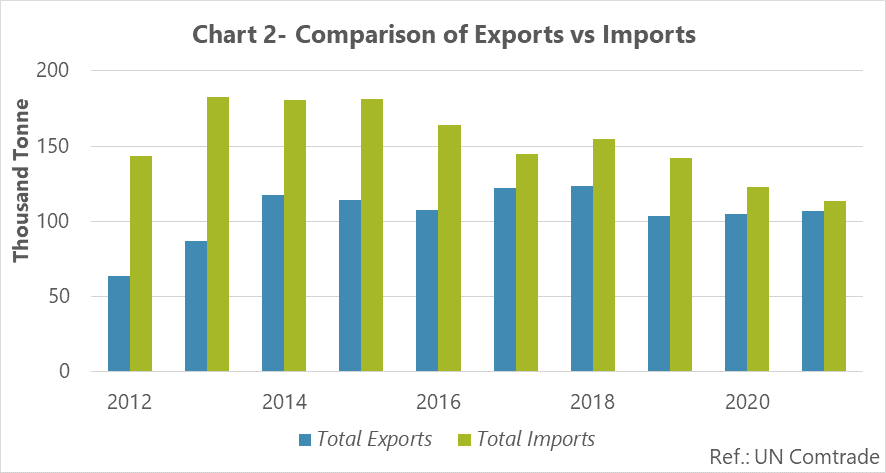

At the end, even though India was the wire rod exporter, it’s considered a destination for South Korea and Japan’s export. During the last 10 years, on average, Japan’s share in the India’s market was estimated at 23%; while this share for South Korea was reported at just 4%. In figure 2, the total wire rod export volume of China, India, Japan, and South Korea with their total import has been shown. As it shows, from 2012 to 2021, there’s been reduction in total import volume and there’s been an increase in total export volume. This case happened because of the reduction in China’s imports and an increase in South Korea’s export.

In 2012, the wire rod import volume in China was equal to 100,723 tonnes and in 2013, this amount increased and reached 111,087 tonnes, but after that, it faced with ups and downs until 2021 when China’s import volume reached 53,146 tonnes which means it decreased about 10%. Also, during the last 10 years, China’s average import was reported 75,017 tonnes. Taiwan and Indonesia are remarkable exporters to China and also in 2021; China’s rank among the world’s importers was 14th.

In 2021, with a 5,2% reduction rather to the last year, India’s imports of this product reached 53,987 tonnes. The average wire rod imports volume in India during the last 10 years, is estimated at 69,334 tonnes and the essential suppliers for this country’s import market were the United Arab Emirates countries and Japan in 2021. India allocated rank 13th among the wire rod importers.

Japan’s import volume with 14% reduction rather than in 2020, reached 5,000 tonnes in 2021. 10 years ago, the average Japan’s import is estimated at 4,543 tonnes, and can point to Malaysia and Thailand as the important suppliers for Japan’s import market. Japan’s rank was 54th among all this product’s importers.

In 2012, the wire rod import volume of South Korea was 7,683 tonnes. In 2021, this number was 1,314 tonnes which means it had a 19% increase rather to the last year. The average wire rod import volume during the last 10 years was reported about 4,022 tonnes. This country allocated rank 76th in the list of wire rod importers in the world. The major suppliers for South Korea’s import market are Germany and the USA in 2021. Generally, in 2021, the total imports of China, India, Japan, and South Korea was 113,447 tonnes rather in 2020, it decreased by about 7,8%.

China, the largest wire rod consumption market in the world

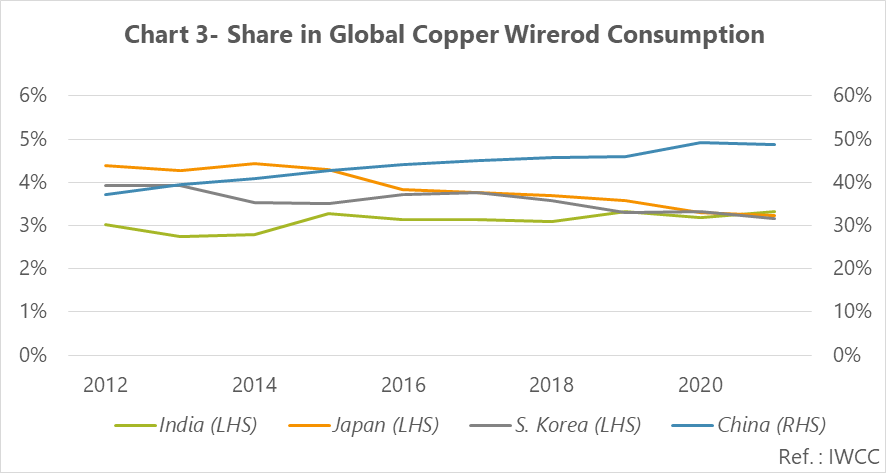

In 2021, the world’s wire rod demand was 18,166kt which increased by 5,3% compared to the previous year when the consumption of this product was reduced due to the spread of Covid19. In 2012 wire rod consumption was estimated at 15,511kt in the world and it had an upward trend by 2019. But in 2020, due to the Covid19 pandemic and the closure of many businesses, the consumption of this product decreased a little and in 2021, it had an upward trend again. In a way that the consumption of wire rod reached 18,227kt in 2021 which had a 3% increase compared to the last year. The average world consumption of this product during the last 10 years was reported 17,184kt. Also, the wire rod demand was equal to 14,829kt in 2012. This amount had an upward trend by 2019 but in 2020 decreased and in 2021 resumed its increase. So that in 2021, the demand for wire rod was equal to 18,166kt which increased by around 5,3% compared to the previous year. In figure 3, the share of wire rod consumption from the world consumption in China, India, Japan, and South Korea has been indicated.

China’s share of the world wire rod consumption in 2012 was estimated at 37% and by 2020, it had a slightly increasing trend and reached 49% and the amount remained still in 2021. Also, the average share of China from the world consumption during 10 years ago was reported equal to 44%.

And India allocated 3% of the world wire rod consumption to itself in 2012. This amount did not change a lot by 2021. India’s share from the world’s consumption was equal to 3,3% in 2021 which had only 0,1% growth compared to 2020. During the 10 year period, the average share of India’s wire rod consumption from the total world consumption was estimated at 3,1%.

Also, in 2012 Japan allocated a 4,4% share of the total world wire rod consumption to itself but until 2021, it had a downward trend, in a way that in 2021, the consumption share of this country was equal to 3,2 which decreased 0,1% compared to the previous year. The average share of Japan in this period was reported about 3,9%.

In 2012 and 2013, the share of wire rod consumption in South Korea compared to the share of the world consumption was reported stable and 3,9%. Then by 2019 accompanied by slight changes till it reached 3,3% and it remained still until 2020. It decreased by 0,1% and it reached 3,2 in 2021. As well, the average share of South Korea’s wire rod consumption compared to this share in the world in the past period was estimated at 3,6%.

Future status

During the 10-year period, China’s share in the global consumption market increased at more rate than its share of the global production market, so China’s consumption market has developed more than its production market. While India and Japan’s shares in these two markets (consumption and production market) change at a same rate and did not differ much. But in South Korea, everything is unlike in China. South Korea’s share of the global production increased at more rate than its share of global consumption market.

Regarding the vast functions of wire rod in different industries which its important one is the electrical industry, it’s predicted that the demand for wire rod will increase with population growth which is itself considered as a driver for the development of the electrical industry; subsequently, the amount of the wire rod production will increase in the coming years in the world. In addition, electrification is one of the most important pillars for reducing carbon emissions and dealing with global warming, which can reduce any risks in the future of the growing wire rod market.