The war between Ukraine and Russia and the subsequent lack of natural gas supply in Europe caused a sharp growth in the price of energy carriers, thus, led to a global drop in alumina production, especially in Europe and South America. Under these circumstance, the market is expected to face risks in near future.

China is the largest producer and consumer of alumina in the world, and the smallest changes in the country will have a significant impact on the production and supply of global alumina. On this basis, there is a great reduction in global alumina production in February, because of Chinese New Year, which decreased around 1Mt in 2021.

Alumina is aluminum oxide, which is an amorphous, odorless, white, and neutral material and is obtained from bauxite. This material is generally produced through the Bayer method or bauxite purification. Alumina has a large number of special properties that not only make this material ideal for aluminum production, but also make it valuable in a wide range of applications. Some of these features include high thermal conductivity, high hardness, resistant abrasion, resistance to chemical changes, corrosion resistance, and good electrical and thermal insulation.

The most consumption of aluminum oxide is for the production of aluminum metal. Oxygen normally reacts with aluminum to reduce metal corrosion. However, when it bonds with oxygen and forms aluminum oxide, a protective coating forms that prevents further oxidation. This coating increases the strength of the metal and protects the aluminum from further damage.

As a neutral chemical, alumina is used as a filler in tires, bricks, and other heavy containers such as furnaces. Due to its high resistance and hardness, this compound is often used as an abrasive for the production of sandpaper and is considered an excellent economic alternative to industrial diamonds. It is worth mentioning that, alumina is consumed in the medical industry, the production of military and protective equipment, the electronic, the jewelry, and the construction industry. Moreover, alumina is produced in two grades, metallurgical and chemical, and the purpose of this report is to investigate the global production of alumina in metallurgical grade, as well as all figures and statistics that are related to this type.

Large-scale alumina producers in the world

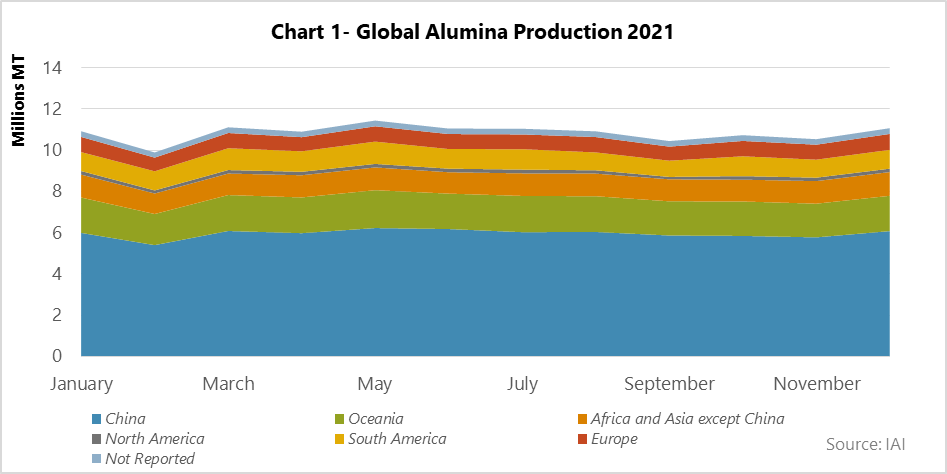

Aluminum Company of China, South32 Limited, Hangzhou Jinjiang Group, Rio Tinto, Norsk Hydro ASA and Alcoa are the six main producers of alumina, in which Alcoa is the largest producer among them. Alumina production is different globally; therefore, the alumina production has been analyzed by different regions in 2021, in chart 1. As the graph also indicates, over 130Mt of alumina will be produced all over the world in 2021, and China with about 55% has the largest production share.

Although China is the largest producer and consumer of alumina in the world; some alumina refineries in the country faced with the growth of production costs due to the higher energy price and the drop in alumina price, which have reduced the profit margin and increases the risk of lower alumina production in China over the coming years.

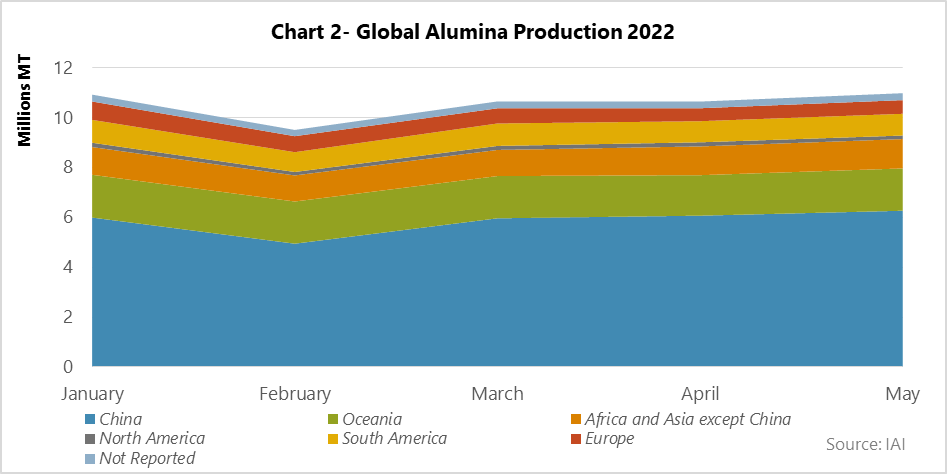

Alumina production will hit a peak of around 11.5Mt in May 2021, which was coupled with a decrease of 4% in May 2022 and reach about 11Mt.

Alumina production has been investigated in two similar time periods in May 2021 and 2022. The results indicate that this has been consistently around 54% in both time periods in China. Furthermore, alumina production was around 50t higher in China in 2021; but its global share has remained constant.

Generally speaking, none of the regions share has not changed significantly over the periods, while this figure has decreased in terms of production volume. However, this does not apply to Europe, and production its share of alumina in May 2022 has decreased by 1%, which is over 192kt. In addition, the South America’s production was affected by the growth of energy prices and global inflation, from over 1Mt of alumina in May 2021 to around 870kt, this indicates 1% drop in the country’s production share in the global trend.

The global production of alumina by region was analyzed in chart 2 from the beginning of 2022 to the end of May. As the chart shows, the lowest amount of alumina production in 2022 occurred in February at 9.5Mt. This drop is due to the Chinese New Year and national holidays in this month, thus, alumina production decreased by 1Mt in February.

It should also be noted that, Europe’s production has also experienced a downward trend since the beginning of 2022, decline from 737kt in January to 551kt in May, down 8% of alumina production in Europe from the beginning of 2022 to the end of May. The price growth of gas and as a result the high price of energy, which is caused by the war between Ukraine and Russia, has led to a production cut, which will probably continue until the end of 2022. Chart 2 indicates that the global production of alumina is facing a crisis in the Q1 2022 and this will continue.

The energy prices growth is the bane for alumina industry

The outlook for energy prices in Europe is a worrying issue due to the significant decline in Russian natural gas supplies. There are also concerns among the main market players about the energy costs in the future, because as Europe enters the winter, gas demand will increase and its production share will probably go down.

High energy costs and global inflation, which jumped as a result of the energy crisis, especially in Europe and the US, indicate the closure of many alumina production plants. There has been a growth in production costs on a global scale, but due to the fact that before the Ukraine-Russia war, Russia was the supplier of natural gas to Europe, the imposition of sanctions against this country led to a shortage of energy supply. As a result, the price increased, which appeared in Europe more than other parts of the world.

Refineries in Spain were shut down and Romania also reduced its production, which is likely that these plants be closed by the end of 2022, according to a valid international sources. Because the importing cost of alumina from China will be lower than its domestic production. This will reduce the maximum production of alumina in Europe.