Aluminum scrap trade had an upward trend from 2011 to 2020, up by 0.1% every year. The trade volume of scrap is directly related to the aluminum price in the LME. With the growth of aluminum prices, downstream companies are more likely to use secondary ingots produced from scrap.

When the price of aluminum ingots is low, the downstream companies are able to purchase primary ingots, and the scrap trade is reduced in this regard. The largest exports volume of aluminum scrap was from the US, which had a 16.9% share of the market. The scrap price is provided by applying a discount to the aluminum ingot. The biggest discount is related to casting scraps. Due to the export of casting scrap, France exports its aluminum scrap with the biggest discount.

Recycling of aluminum scrap, like the process of recycling other metals, including copper and iron, is first done by collecting these scraps. Beverage cans, foil, trays, and aerosol cans are aluminum scrap that are collected from homes, and of course, workshop wastes, especially from aluminum door and window factories, make up a significant part of these wastes. After collecting the wastes, they must be separated and compressed first so that they occupy less space. The compressed aluminum scrap is then subjected to cleaning, melting and casting process in reprocessing factories and finally secondary aluminum scrap is made.

Aluminum has found a special place in today’s industry because of its reprocessing ability with very low energy consumption compared to other metals. As far as this metal is referred to as green metal; because the required energy to recover it from secondary sources (scrap) is around 8% on average of the energy required to produce it from primary sources (minerals, such as bauxite) or even less.

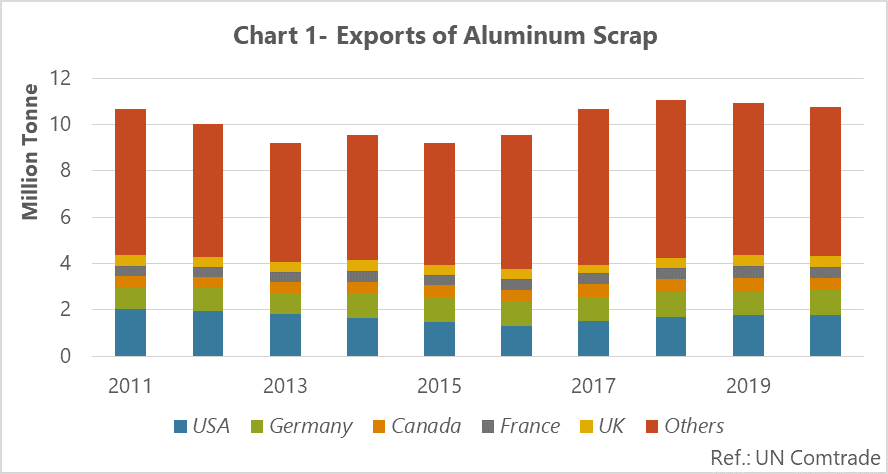

Figure 1 shows the global trade in aluminum scrap. The product’s overall trend in the world has been upward from 2011 to 2020, as in this figure. The trade trend of aluminum scrap decreased from 2011 to 2014, and then it was coupled with growth and continued until 2018. One of the reasons for the trade drop was the lower global price of aluminum in the market. In fact, when the aluminum price falls, consumers of aluminum ingots prefer to purchase primary ingots, which have much better quality in terms of chemical properties.

When the aluminum price on the LME increases, downstream companies are driven to purchase secondary ingots (resulting from scrap melting). At a time when the price of aluminum and primary pure ingots increases to such an extent that it becomes difficult for consumers to provide it. In such a situation, the downstream plants will mainly turn to scrap consumption to substitute their demand. The trade in secondary sources of aluminum (scrap) changes as the global price of aluminum, as Atubis assessments. Accordingly, in periods when the aluminum price increases, the desire to trade scraps goes up, and when it decreases, there is a greater desire to consume it.

The exports of aluminum scrap hit a peak of 11.1Mt in 2018, aluminum was priced at around $2,111 on the LME in 2018, which grew by 13.2% compared to 2014, and subsequently caused a 15.8% increase in the global export of aluminum scrap.

The United States as the largest exporter of aluminum scrap

Without any doubt, the countries that consume more aluminum are the countries that are the largest scrap producers as well. The US exported the largest amount of aluminum scrap from 2011 to 2020, which exports an average of 1.7Mt/y of scrap to other countries. After the US, the countries of Germany, Canada, France, and the UK hit a peak of aluminum scrap exports. In total, these 5 countries exported about 4.3Mt of scrap, out of 10.7Mt of the product.

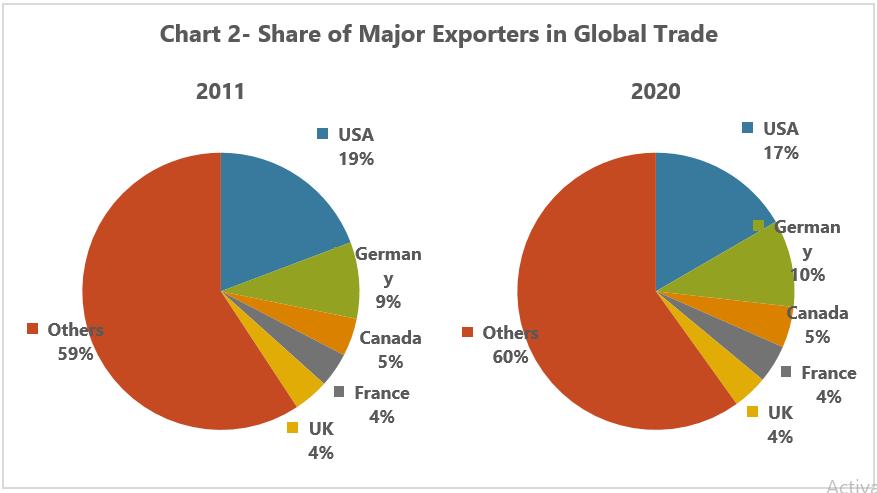

The US share was about 19.3% in the export of aluminum scrap in 2011, down by 2.7 percentage points to 16.6% in 2020. Germany’s share of scrap exports was about 8.9% in 2011, up 1.3% and reached 10.2% in 2020. Canada’s share was around 4.4% in 2011, which reached 4.8% in 2020 with a growth of 0.4 percentage points. France had a share of 4.0% of scrap exports in 2011 and increased to 4.4% in 2020. The UK’s share was 4.1% in 2011, which remained constant in 2020.

The low export price of France’s scrap

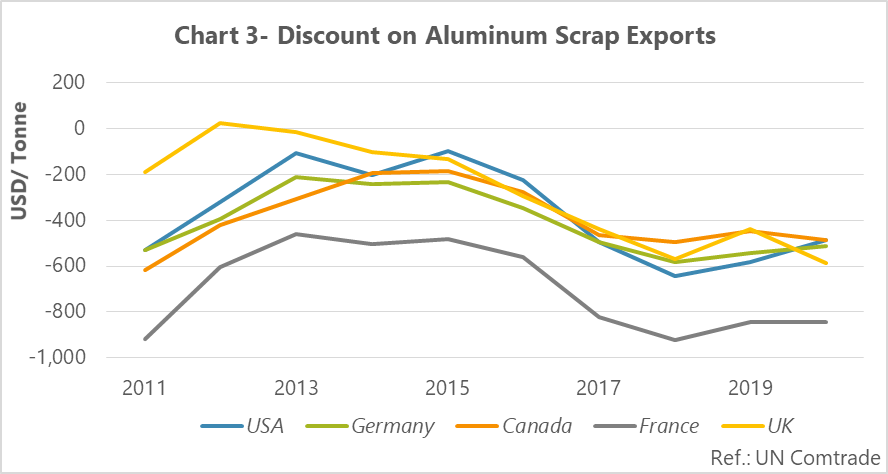

The price of aluminum scrap is determined based on the aluminum ingots in the LME with discounts. Moreover, the type of scrap also affects its price, which vary depending on the alloy and contamination. Changes in the FOB discount of aluminum scrap is against the exports trend and is in line with the aluminum price changes of in the LME, due to Atubis. The highest discount was related to France with $924/t over the timeframe.

France’s aluminum consumption is driven by the packaging, construction, and automotive sectors. The average European auto industry currently has over 130 kg of aluminum (about 10% of weight) and this amount is increasing, which also grew the production of end-of-life aluminum waste from the sector. Since the price of foundry scrap is lower than other aluminum scrap and France exports mostly auto scrap, it offers higher discount. Among the US, Germany, Canada, and the UK, the lowest discount is related to the US, which also has the lowest share among the 5 top countries. Since 2017, the US have been able to export aluminum scrap with a greater discount than Germany, Canada, and the UK, which has taken the largest share among these countries. The supply growth of scrap was one of the reasons for the US price drop of aluminum scrap in 2017.